Keywords: Off-Grid Solar ROI, Industrial Energy Independence, Renewable Energy Economics, Commercial Off Grid Solar Systems

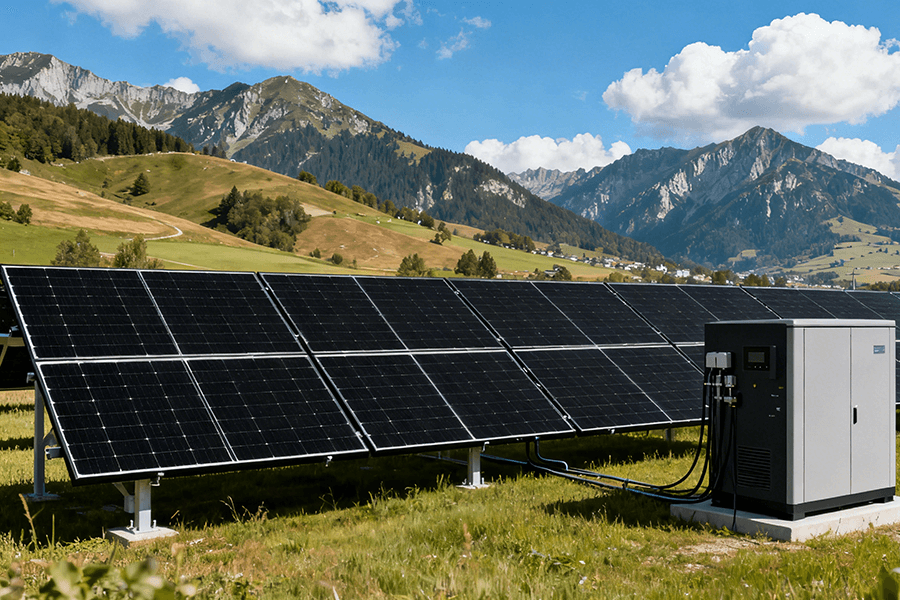

Why Off Grid Solar is Critical for Modern Industries?

Off-grid solar systems are no longer limited to rural households. In commercial and industrial (C&I) sectors, they provide energy resilience, cost predictability, and sustainability compliance. According to the International Energy Agency (IEA), global off-grid solar capacity for C&I applications grew by 23% annually between 2020-2025, driven by rising grid instability and carbon pricing policies (IEA, 2025).

Key Applications & Case Studies

Case 1: Canadian Gold Mine – Replacing Diesel Generators

Background

A remote gold mine in Yukon, Canada, consumed 1.2GWh/year via diesel generators (electricity cost: $0.35/kWh).

System Configuration

- Solar PV: 2MW array (5,120 x 390W bifacial panels)

- Battery Storage: 4MWh lithium-ion (Tesla Megapack)

- Backup: 500kW diesel generator (reserve only)

Financial Analysis

| Parameter | Diesel System | Solar Hybrid System |

|---|---|---|

| Annual Fuel Cost | $384,000 (320k L diesel × $1.2/L) | $0 |

| O&M Cost | $50,000 | $18,000 |

| Capital Cost | $0 (existing) | $1.8 million |

| LCOE (25-year) | $0.35/kWh | $0.12/kWh |

ROI Calculation

- Annual Savings: $384k (fuel) + $32k (O&M) = $416k

- Payback Period: $1.8M / $416k ≈ 4.3 years

- 25-Year Net Profit: ($416k × 25) – $1.8M = $8.6M

Case 2: German Agri-Food Processing Plant – Grid Instability Mitigation

Background

A Bavarian meat processing plant faced grid outages (avg. 8 hours/month), risking €500k/month in spoiled inventory.

System Design

- Solar PV: 1.5MW rooftop + 0.5MW ground-mounted

- Storage: 3MWh vanadium flow battery (10-hour discharge)

- Control System: AI-driven load scheduling (Maxbo EnergyOS™)

Performance Metrics

- Energy Coverage: 92% from solar, 8% from grid backup

- Outage Protection: 100% uptime during 2023 grid failures

- CO2 Reduction: 1,200 tons/year (vs. grid mix)

Economic Impact

- Avoided Losses: €500k/month × 12 = €6M/year

- Energy Savings: €180k/year (grid cost reduction)

- Government Subsidies: €450k (EU Just Transition Fund)

Typical System Configurations & Costs

| Component | Specifications | Cost Range (USD) |

|---|---|---|

| Solar PV Array | 500 kW – 5 MW (mono PERC, 21% efficiency) | $0.45 – $0.65/W |

| Battery Storage | 1 – 10 MWh (Li-ion or flow battery) | $300 – $500/kWh |

| Inverter & Controller | Hybrid inverters (95%+ efficiency) | $0.10 – $0.20/W |

| Total System Cost | 1 MW system with 2 MWh storage | $1.2M – $1.8M |

Source: BloombergNEF (2025), “Off-Grid Solar Cost Trends”

Benefits of Commercial Off-Grid Systems

- Cost Predictability: Lock energy costs for 20+ years, avoiding volatile fossil fuel prices.

- Energy Security: Eliminate grid outage risks (critical for cold storage, data centers).

- Sustainability: Align with RE100 or Science-Based Targets (SBTi) commitments.

- Tax Incentives: US ITC (30% tax credit) and EU’s Innovation Fund subsidies.

Spotlight: Maxbo Solar’s Off-Grid Innovations

Maxbo Solar, a leader in industrial solar solutions, offers integrated off-grid systems with:

- Hybrid Inverters: Seamless switching between solar, storage, and backup generators.

- AI-Powered EMS: Real-time load optimization (up to 15% energy savings).

- Case Example: A Maxbo-designed 3.5 MW system for a Texas logistics hub reduced annual energy costs by $520,000 (Maxbo Solar, 2024).

Maxbo Solar: Pioneering Off-Grid Industrial Solutions

Maxbo’s integrated systems feature:

- High-Efficiency Modules: 22.8% PERC cells with 30-year warranty.

- Adaptive Storage: Hybrid lithium-ion/flow batteries for >15,000 cycles.

- AI Optimization: Real-time demand forecasting and fault detection.

Project Spotlight: Maxbo’s 5MW off-grid system for a Chilean copper mine reduced diesel use by 1.2M liters/year, achieving 26% IRR.

Conclusion

Commercial off grid solar is redefining energy economics, delivering 4-year payback and zero operational emissions. As battery costs drop 89% since 2010 (BNEF), industries from mining to data centers are adopting these systems not just for sustainability, but for hard-nosed profitability.

References

- International Energy Agency (IEA). (2024). World Energy Investment Report.

- National Renewable Energy Laboratory (NREL). (2023). Decarbonizing Heavy Industries.

- BloombergNEF. (2024). Battery Price Survey.

Email: [email protected]