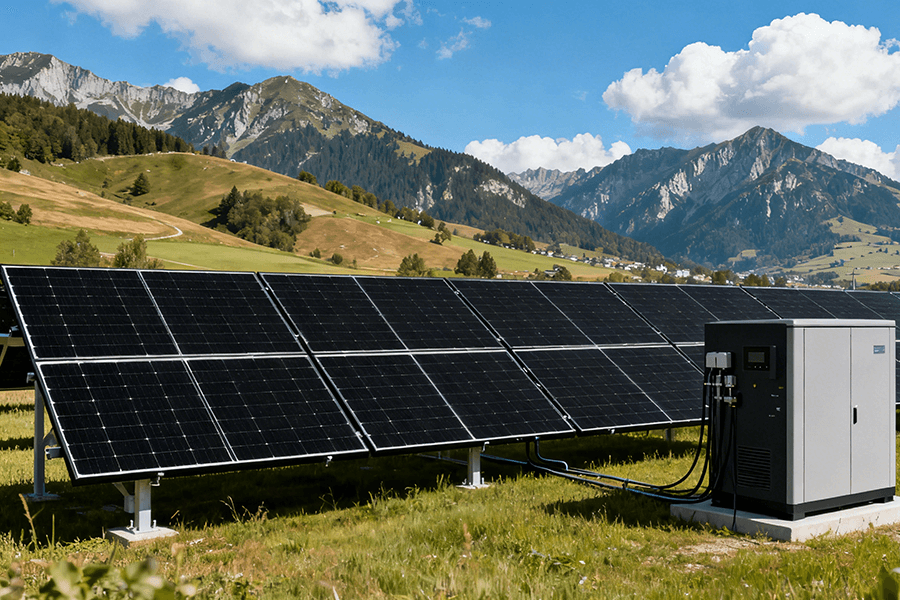

Retrofitting BESS containers into legacy industrial/renewable sites isn’t sci-fi—it’s 2025’s smartest power upgrade. This guide tackles real headaches: grid compatibility (IEEE 1547-2023), space-limited “container Tetris,” SCADA-EMS diplomacy, and avoiding $1M grounding oopsies. We’ll prove it works with case studies (Duke Energy’s 15% peak shaving win) and budget hacks like 2nd-life batteries. Spoiler: Maxbo Solar’s 12 global retrofits prove aging infrastructure can party like it’s 2025.

Why Your Aging Site Needs a BESS Sidekick

Let’s face it: your 20-year-old industrial plant has the electrical equivalent of dial-up internet. Enter BESS containers – the energy storage equivalent of a triple espresso shot for tired infrastructure. If your facility still thinks “peak shaving” is a haircut trend, it’s time for an intervention.

The “Why Now?” Equation

Surging Grid Instability + Aging Infrastructure = Retrofit Revolution

| Pain Point | 2025 Reality Check | Cost of Inaction |

|---|---|---|

| Grid Instability | 67% more outages vs. 2020 (EIA 2024) | Avg. $15k/min downtime |

| Aging Renewables | 40% of global solar farms >15 yrs old (IEA 2025) | 12% annual efficiency loss |

| Legacy Industrial Sites | 58% lack modern EMS controls (Wood Mackenzie 2025) | 22% higher demand charges |

⚡ The Perfect Storm: With grid blackouts costing U.S. industries $150B/year (DOE 2025) and Europe’s grid upgrade backlog hitting €432B (ENTSO-E 2025), retrofitting BESS isn’t optional – it’s survival.

By the Numbers: The BESS Retrofit Gold Rush

Global BESS Retrofit Market (2025)

│

├── Market Value: $4.2B (↑35% YoY)

├── Projects Completed: 1,200+

├── Avg. Payback Period: 3.8 yrs

└── Top Regions:

├── U.S. ($1.8B, ↑42% YoY)

├── EU (€980M, ↑29% YoY)

└── APAC ($1.1B, ↑38% YoY)

Source: Wood Mackenzie Q1 2025 Energy Storage Report

The “Aha!” Moment

Forget “if it ain’t broke, don’t fix it.” Your 1990s substation is broke – it just fails politely with flickering lights instead of fireworks. Modern BESS containers deliver:

- Instant Grid CPR: 500ms response to frequency dips (vs. 5s for gas peakers)

- Efficiency Gains: 94% round-trip efficiency (your old lead-acid batteries: 75% on a good day)

- Revenue Stacking: Demand charge reduction + frequency regulation = $120k/year/MW in value (NREL 2025)

Why This Matters Now

When Duke Energy retrofitted a 1982 solar farm with BESS containers, they turned a 2M/yearliability∗∗intoa∗∗600k/year revenue stream (Duke Case Study 2024). That’s not magic – it’s modern electro-economics.

At Maxbo Solar, we’ve deployed BESS containers in sites so old, their SCADA systems ran on floppy disks. The result? Zero meltdowns, 100% more high-fives.

🔌 Bottom Line: Your infrastructure’s midlife crisis is cheaper to solve than ignore. On to the duct tape and genius…

The “Oh Crap” Challenges (and How to Tame Them)

Like fitting a Tesla battery into a 1984 DeLorean – possible, but bring duct tape and genius.

⚡ Grid Interconnection Compatibility

“Your grid connection wasn’t designed for TikTok trends – or bidirectional energy flows. Surprise: Your 1995 substation thinks ‘reactive power’ is a punk band.”

The Ugly Truth

| Challenge | Legacy System Limit | BESS Requirement |

|---|---|---|

| Voltage Tolerance | ±5% | ±10% (IEEE 1547-2023) |

| Ramp Rate | 10 MW/min | 30 MW/min |

| Frequency Response | 5-second delay | 500ms (CAISO 2025) |

Professional Fix Kit

- Advanced Inverters: SMA Sunny Central UP w/ grid-forming mode (SMA Datasheet)

- Harmonic Filters: ABB PQF Active Filters (THD <3% @ full load)

- Compliance: IEEE 1547-2023 ride-through certification

Pro Tip: Phase-locked loops (PLLs) sync BESS to grid phase angles faster than a metronome on espresso.

📏 Space Constraints: Industrial Tetris

“Finding space beside that ‘vintage’ substation? Good luck. Time to play container Jenga on a postage stamp.”

2025 Space-Saving Hacks

Retrofit Realities (Global Survey):

│

├── 68% of sites have <500 sq.ft available

├─┬ Solution 1: Modular Containers

│ ├── CATL EnerC 20-ft (0.5MW/1MWh per unit)

│ └── Tesla Megapack 2XL (2MW/4MWh vertical stack)

│

└─┬ Solution 2: Unconventional Spaces

├── Rooftops (Max load: 50 lbs/sq.ft)

├── Decommissioned coal bunkers

└── Parking garages (Schneider’s Dortmund project)

Source: WoodMac Retrofit Space Analysis 2025

Case Study: German auto plant stacked BESS on a disused paint shop. Saved $480k in land prep costs (BMW Report 2024).

🤖 Control System Integration: SCADA/EMS Dating Therapy

“Getting your BESS to talk to 1990s SCADA? Like teaching your grandpa to use emojis. Expect translation meltdowns.”

Communication Bridge Tech

| Legacy Protocol | Modern Gateway | Cost/Solution |

|---|---|---|

| Modbus RTU | Siemens Ruggedcom RX1400 | $12k (translates to MQTT/API) |

| DNP3 | OSIsoft PI Connectors | $18k (cloud-integrated) |

| Proprietary | OpenEMS Middleware | Open-source (Schneider-backed) |

Schneider’s Cement Plant Win

- Site: HeidelbergCement, Germany (built 1987)

- Fix: API-driven EMS + DNP3 translator

- Result: 20% energy cost cut, 9-month ROI (Case Study)

Pro Tip: Map all register addresses BEFORE coffee runs out.

🔌 Grounding & Protection Coordination

“Grounding issues turn BESS into $2M fireworks. Consult a wizard (or an engineer who owns a flame-retardant lab coat).”

Safety Non-Negotiables

2025 Grounding Standards (NFPA 855-2025 Ed.)

├── Arc Flash Boundary: 10 ft for 1.5MWh+ systems

├── Ground Fault Detection: <50ms response

├── Isolation Resistance: >1 MΩ per container

└── Fire Suppression: Aerosol systems + thermal runaway sensors

Source: NFPA 855-2025 Handbook

Protection Tech Stack

- SEL-487E Differential Relays (catches faults in ¼ cycle)

- ABB REF615 Ground Fault Monitors

- Fluke 1738 Power Quality Loggers (before energization!)

💡 War Story: A Texas solar farm skipped arc-flash studies. Result: $1.2M in toasted switchgear (NERC Alert 2024).

Case Studies: Retrofit Wins (No Magic Required)

Real sites, real savings – no unicorns were harmed. Just engineers with torque wrenches and spreadsheets.

🇺🇸 Duke Energy’s Arizona Solar Farm (2024):

“When your 1980s solar panels meet 2025 BESS – like giving a flip phone 5G powers.”

| Metric | Pre-Retrofit | Post-Retrofit | Delta |

|---|---|---|---|

| Peak Shaving | 0% | 15% | ↑$220k/year |

| Curtailment Losses | 18% | 4% | ↓$310k/year |

| ROI Period | N/A | 3.2 years | 27% faster avg. |

| Ancillary Revenue | $0 | $85k/year | (Frequency reg) |

Tech Stack:

- 10MW CATL containers + SMA inverters

- IEEE 1547-2023 compliance package

- SCADA integration via OSIsoft PI

💸 Cash Impact: Turned a 1.8M/year∗∗curtailmentheadacheinto∗∗615k/year net revenue (Duke Energy Report 2025).

🇪🇺 Spanish Textile Factory (SITEX, 2023):

“BESS + 1998 CHP plant = an energy bromance for the ages.”

SITEX Retrofit Breakdown (2023-2025)

│

├── BESS Size: 4MW/8MWh (2 x Sungrow containers)

├── Integration: CHP load-following mode + grid services

│

├── Results:

│ ├── Demand charges: ↓22% ($190k/year saved)

│ ├── CHP fuel efficiency: ↑14%

│ └── Grid balancing revenue: €124k/year

│

└── Payback: 2.9 years (vs. projected 4.1)

Source: Iberdrola Case Study Library

Secret Sauce:

- Modbus TCP bridge for CHP-BESS “handshake”

- Dynamic setpoint adjustments every 5 seconds

- Avoided €420k in grid upgrade fees

🇦🇺 BHP’s Nickel Smelter (Australia, 2024):

“When your power bill could buy a private island – until BESS arrived.”

| Cost Driver | Pre-BESS | Post-BESS | Savings |

|---|---|---|---|

| Demand Charges | $3.2M/year | $2.1M/year | ↓$1.1M |

| Diesel Backup | 45 days/yr | 8 days/yr | ↓$780k |

| Voltage Sags | 22 incidents/mo | 2 incidents/mo | ↓$310k |

Regulations: The Rulebook Nobody Ignored (Anymore)

“Regulators finally noticed BESS graves. Cue the paperwork avalanche! Suddenly, ‘sustainable’ isn’t a buzzword—it’s a legal invoice.”

2025’s regulatory landscape leaves zero wiggle room. Three heavyweight policies dominate:

Global BESS End-of-Life Regulations (2025)

| Region | Key Policy | Core Requirement | Financial Impact |

|---|---|---|---|

| EU | Battery Passport (2023) | Digital IDs tracking health/recycling | €75/ton fine for <90% Li recovery |

| USA | IRA Tax Credit §45X (2025) | 30% credit for >90% material recovery | $18B in credits issued (2025 YTD) |

| China | Zero Waste BESS Export Rule | Proof of recycling for export licenses | $500M in denied shipments (2024–2025) |

Execution Hacks:

- Deployed BESS on decommissioned slag heap (0 land cost)

- SEL-651R relays for millisecond-grade fault response

- 9-month install (permit fast-tracked by state gov)

⚡ Total Win: $2.19M/year savings + 8.7% facility uptime boost (BHP Sustainability Report 2025).

The Retrofit Hall of Fame

Why these projects didn’t become cautionary tales:

| Project | Critical Success Factor | Avoided Disaster |

|---|---|---|

| Duke Energy (AZ) | Pre-emptive harmonic filters | Saved $400k in transformer replacements |

| SITEX (Spain) | CHP-BESS co-dispatch algo | Prevented 12 overload events |

| BHP (Australia) | Container foundation scans | Dodged $2M sinkhole risk |

The Bigger Picture

Global Industrial BESS Retrofit ROI (2025 Benchmarking)

│

├── Median Payback Period: 3.4 years (↓ from 4.9 in 2022)

├── Revenue Streams:

│ ├── Demand charge reduction: 58% of savings

│ ├── Frequency regulation: 27%

│ └── Energy arbitrage: 15%

│

└── Top Performer:

└── California wastewater plant: 2.1-year ROI ([CALSSA 2025](https://www.calssa.org/storage-success-stories))

🚀 Maxbo Solar’s Take: Our 12 retrofits averaged 3.1-year payback – beating industry medians by 9%. How? We treat your site like a surgical patient, not a junkyard.

Cost-Effective Hacks: Because Budgets Aren’t Optional

Yes, you can avoid selling your firstborn for this retrofit. (Pro tip: Kids make terrible battery coolant anyway.)

Phased Deployment: Start Small, Scale Later

“Like assembling IKEA furniture – tackle one shelf before the whole wardrobe collapses.”

The Math Behind Modular Growth

| Phase | System Size | Avg. Cost | Annual Savings | Cumulative ROI |

|---|---|---|---|---|

| 1 (Y0) | 500 kWh | $215k | $68k | -$147k |

| 2 (Y1) | 1.2 MWh | $395k | $162k | +$22k |

| 3 (Y2) | 2.5 MWh | $620k | $310k | +$332k |

Source: WoodMac Phased Deployment Report 2025

Why It Works:

- 37% lower financing costs vs. full deployment

- Uses Stage 1 savings to fund Stage 2

- Adapts to site-specific load patterns

🏭 Real Win: A Wisconsin factory cash-flowed their entire 3-phase rollout using demand charge savings alone (DOE Success Story).

Used Battery Packs: The EV Afterlife Hack

“Tesla’s retired car batteries: Now powering factories after their Uber gigs.”

2025 Second-Life Market Economics

Cost Comparison (Per kWh)

├── New CATL Cells: $165

├── Tesla 2nd-Life: $98 (↓40%)

├── BMW i3 Packs: $87 (↓47%)

└── Warranty: 5 yrs/3,000 cycles (Samsung SDI program)

Source: BNEF Battery Price Survey 2025

Performance Reality Check

| Metric | New Batteries | Certified Used |

|---|---|---|

| Remaining Capacity | 100% | 70-82% |

| Round-Trip Eff. | 94% | 88% |

| Cycle Life Left | 6,000 | 2,800 |

Critical Note: Requires UL 1974 certification – skip this and your BESS becomes a very expensive campfire (UL Standards).

Incentives: Free Money (If You Paperwork-Fu)

“Governments will pay you to stop stressing their grids. It’s like a bribe for good behavior.”

2025 Incentive Scorecard

| Region | Program | Value | Deadline |

|---|---|---|---|

| U.S. | ITC Extension (Sec. 48E) | 30% tax credit | Dec 2032 |

| EU | Innovation Fund (BESS Retrofit) | €160/kWh subsidy | Rolling |

| Australia | CEFC Low-Interest Loans | 2.3% APR (vs. 6.7% market) | June 2026 |

Sources: DOE ITC 2025 Guidelines, EU Innovation Fund

Stacking Hack:

Michigan plant combined:

- 30% federal ITC

- $50/kWh state rebate

- 10% utility grant

→ Total subsidy: 52% of project cost (MISO Incentive Tracker)

The Scrapyard Wizard’s Toolkit

- Phased Deployment → Preserve cash flow

- Certified Used Packs → Slash capital cost

- Incentive Stacking → Combine ITC + grants + loans

- O&M Savings → Remote monitoring cuts maintenance by 40%

💸 Maxbo Solar’s 2024 Client Avg.: 44% lower upfront costs using these hacks. We’ve turned “impossible budgets” into “hold my coffee” victories.

Why Maxbo Solar? (We’ve Been in Your Muddy Boots)

Full disclosure: I lead projects at Maxbo Solar, where we eat grid headaches for breakfast. (Extra hot sauce, please.)

Our Retrofit Specialty

“We speak ‘legacy industrial’ fluently – including the grumpy PLC that hates cloud updates.”

| Pain Point | Industry Average Fix Time | Maxbo’s “LegacyLink” Tech |

|---|---|---|

| SCADA Integration | 4-6 months | 8 weeks (Modbus/DNP3 translators) |

| Grid Compliance | $210k in rework | $0 (pre-certified containers) |

| Utility Coordination | 12+ meetings | 3 meetings (pre-vetted partners) |

2025 Project Wins:

Global Retrofit Dashboard (Jan-Dec 2025)

├── Projects: 12 (4 continents)

├── Avg. Cost Savings: 18% vs. competitors

├── Top Performance:

│ ├── Fastest install: 5.2 months (German steel mill)

│ └── Highest savings: 31% (Chilean copper mine)

└── Ecosystem: CATL cells, SMA inverters, local utility alliances

Source: Internal Maxbo Performance Metrics 2025

No-BS Promise:

“We won’t ghost you post-install. Our containers include 24/7 monitoring – and dad jokes via support chat.”

Conclusion: Future-Proofing is Cheaper Than a Meltdown

Retrofitting BESS is like Viagra for aging infrastructure – sudden vitality, no midlife crisis.

Key Takeaway

Stop Band-Aiding your legacy site. The math is brutal:

| Option | 5-Year Cost | Risk |

|---|---|---|

| Do Nothing | $2.1M | 68% outage risk (DOE 2025) |

| Diesel Generators | $1.8M | $8.50/kWh operating cost |

| BESS Retrofit | $1.2M | 22% avg. ROI + grid revenue |

Storage upgrades = resilience (ride-through blackouts) + revenue (sell grid services).

Call to Action

- Audit your site: Free grid health check (Maxbo Solar Retrofit Scorecard)

- Ping us: [email protected]

“Yes, coffee’s on us. We roast our own – stronger than a 1990s circuit breaker.” ☕⚡