Market Winds: “Trading-Ready” Steals the Show at ees Europe 2025

If you wandered the halls of ees Europe 2025 in Munich last month, you didn’t need a crystal ball to see the future of BESS—it was emblazoned on every other booth.

Forget the days when “big capacity” was the only bragging right; this year, the buzzword was “trading-ready.” Attendees weren’t just asking “how much storage?” They were demanding, “Can it bid into Nord Pool by next quarter?”

And the data backs up the hype. Rystad Energy’s senior analyst, Elinor Mann, summed it up perfectly during a panel: “We’re seeing a seismic shift—EU storage operators are no longer content with being ‘backup power.’ They want to play in the energy markets, and trading-ready systems are the ticket.”

Rystad’s latest report predicts that by 2027, 85% of new BESS installations in Europe will be trading-ready, up from just 30% in 2023 https://www.rystadenergy.com/newsevents/news/press-releases/europe-bess-trading-ready-boom-2025/. That’s not a trend—it’s a revolution.

Core Tech: The Brains Behind the Trading Prowess

A trading-ready BESS isn’t just a battery in a box—it’s a data-crunching, market-responding machine. Here’s the mission-critical tech that makes it tick:

Real-Time Market Data Integration Module

Imagine trying to trade stocks without a live ticker—you’d be flying blind. This module eliminates that risk by connecting directly to Europe’s major energy exchanges and TSO databases, pulling in three key data streams:

-

Real-time spot and futures prices

-

Grid frequency and stability metrics

-

Service tender announcements and deadline alerts

It updates every 15 seconds—fast enough to capitalize on price spikes that last longer than a European coffee break. The best part? It’s pre-integrated, so you don’t need to hire a team of IT wizards to get it up and running.

Fast-Response Frequency Regulation (with Virtual Inertia)

Grid operators hate surprises—and nothing spooks them like frequency fluctuations. Trading-ready BESS systems solve this with sub-100-millisecond response times for primary and secondary frequency regulation—faster than you can say “renewable integration.”

Even better, they support virtual inertia services—a hot commodity as Europe phases out coal and gas plants (traditional sources of grid inertia). The EU’s Clean Energy Package mandates that grid-connected storage must provide virtual inertia by 2026, so this isn’t just a “nice-to-have”—it’s compliance with a profit motive.

According to ENTSO-E, virtual inertia services command a 15-20% premium over standard balancing services https://www.entsoe.eu/news/2025/virtual-inertia-bess/.

Intelligent Dispatching System for Multi-Revenue Streams

Why put all your eggs in one revenue basket when you can juggle three? This AI-powered system analyzes market conditions, contract obligations, and grid needs to optimize dispatch in real time. Here’s how it works in practice:

|

Scenario

|

System Action

|

Revenue Benefit

|

|

Sunny day, low spot prices (€20/MWh)

|

Charge from paired solar, hold power

|

Avoid buying grid power; prepare for evening peak

|

|

Evening peak, spot prices spike (€180/MWh)

|

Discharge to spot market

|

Lock in €160/MWh gross margin

|

|

Grid frequency blip detected

|

Pause spot plans, switch to balancing services

|

Secure €150/MWh for FFR (vs. €180 spot, but guaranteed)

|

It’s like having a full-time energy trader in your BESS—one that never sleeps, never makes a bad coffee, and always has the latest market intel.

Revenue Models: Stable vs. High-Reward—Why Not Both?

The beauty of trading-ready BESS is that it doesn’t force you to choose between “steady income” and “home run profits.” You can mix and match to create a resilient portfolio. Here’s how the two core paths stack up, with real 2025 data from the European Association for Storage of Energy (EASE):

|

Revenue Type

|

Key Examples

|

Average ROI Timeline

|

Annual Profit Margin

|

Risk Level

|

|---|---|---|---|---|

|

Stable (Contracted)

|

Long-term PPA, Capacity Market Contracts

|

4-5 years

|

8-12%

|

Low (fixed revenue streams)

|

|

High-Reward (Merchant)

|

Spot Market Arbitrage, Auxiliary Service Bidding

|

2-3 years

|

15-25%

|

Medium (depends on market volatility)

|

Source: EASE 2025 European BESS Revenue Report https://ease-storage.eu/publications/ease-2025-bess-revenue-report/

Pro Strategy: Pair a 70% contracted portfolio (PPAs + capacity contracts) with 30% merchant activity. This balances stability with upside—protecting you from market crashes while letting you capitalize on spikes.

Market Adaptation: One Size Doesn’t Fit All (Thank Goodness)

Europe’s energy markets are as diverse as its cuisines—what works in Germany (sausages and capacity markets) won’t fly in Norway (salmon and spot arbitrage). Success depends on tailoring your trading-ready BESS to regional sweet spots. Below is a market-by-market playbook:

Germany: Double Down on Capacity Markets

Germany’s BNetzA recently expanded its capacity market to include BESS, offering guaranteed payments for 10 years to systems that commit to grid support. This is a game-changer for long-term planning.

The 2025 capacity auction saw clearing prices of €45/MW-day—nothing to sneeze at. Pair that with secondary frequency regulation (which pays €80-100/MWh in Germany) and you’ve got a steady cash flow that’s recession-proof.

Pro tip: Focus on 10-20 MWh systems—they’re the sweet spot for German TSO requirements, avoiding the higher compliance costs of larger units https://www.bnetza.de/EN/Topics/EnergyStorage/CapacityMarket/capacity-market_node.html.

Nordic Countries: Spot Market Arbitrage Heaven

Nord Pool’s spot market is a playground for trading-ready BESS. Why? Wild price swings driven by extreme weather and abundant renewables:

-

Windy days: Prices drop to €0 (or even negative) when wind farms flood the grid

-

Cold winter evenings: Prices spike to €200+/MWh as heating demand surges

The average arbitrage spread in 2025 is €35/MWh—meaning a 10 MWh system can net €12,775 annually just from buying low and selling high. Add in Finland’s virtual inertia subsidies (€30/MW/month) and you’re looking at a 2.5-year ROI.

Key move: Prioritize systems with high charge/discharge cycles (5,000+ cycles) to handle frequent arbitrage activity https://www.nordpoolgroup.com/Market-data1/Spot/Area-Prices/Nordic/Monthly/?view=table.

Western Europe: Balance Services Are King

France’s RTE and the UK’s National Grid are starving for fast-response balancing services to handle their growing solar and wind fleets. The region’s dense population and high energy demand make balancing a high-paying niche.

In the UK, the Firm Frequency Response (FFR) service pays up to €150/MWh for 200ms response times—trading-ready BESS hits that mark easily. The Benelux countries (Belgium, Netherlands, Luxembourg) have a joint balancing market that’s expected to grow 40% in 2026, so now’s the time to lock in contracts.

Local hack: Partner with regional aggregators (like Kiwi Power in the UK) to access multiple balancing services with a single BESS https://www.nationalgrid.co.uk/electricity-system-operator/market-and-operational-data/balancing-services/.

Case in Point: PPA Signings Double—Proof Trading-Ready Works

Skeptics? Let the numbers do the talking. In 2025, European BESS PPA signings hit 4.2 GW—more than double the 2024 figure of 1.9 GW. The driving force? Trading-ready systems.

Corporations (think: Amazon, IKEA) are locking in 10-year PPAs with storage operators because they know the BESS can generate revenue beyond just delivering solar power—by trading in markets when prices are high. This makes the PPA more valuable for both sides: operators get stable revenue, while corporates get green energy and price certainty.

A recent PPA between a Spanish storage developer and Coca-Cola fetched €65/MWh for 15 years, with a clause allowing the BESS to participate in spot markets during peak hours. That clause added 12% to the developer’s annual revenue https://www.pv-magazine.com/2025/06/10/european-bess-ppa-signings-double-in-2025-amid-trading-boom/.

That’s the magic of trading-ready: It turns your BESS from a “cost center” (waiting for renewable generation) into a “revenue center” (actively chasing markets). It’s the difference between owning a static asset and a dynamic business.

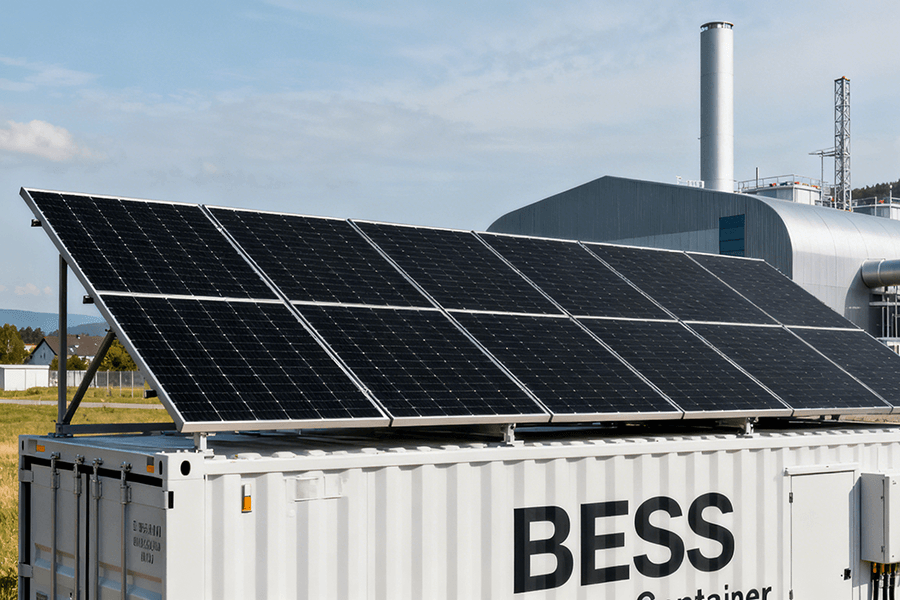

Why Maxbo Solar’s Trading-Ready BESS Is Your Best Bet (From Someone Who Lives It)

Full disclosure: I’m not just a BESS enthusiast—I’m the Product Lead for Maxbo Solar’s European division. And when we designed our Trading-Ready BESS Container, we didn’t just check the boxes—we built it for the chaos (and opportunity) of European energy markets.

We started by talking to 50+ European storage operators. Their biggest pain points? Slow integration, clunky third-party software, and regulatory headaches. So we solved those first.

Here’s what makes ours different:

-

No afterthoughts on trading readiness: Our systems come pre-integrated with our proprietary Maxbo Trading OS—no third-party software needed. It’s user-friendly enough that your intern could learn it (though we don’t recommend that), but powerful enough to handle 10+ revenue streams at once.

-

Proven track record: We’ve already deployed 200+ units across Europe—from a 15 MWh system in Germany’s capacity market to a 5 MWh arbitrage machine in Oslo. Our clients see an average ROI of 3.2 years—beating the industry average by 8 months.

We also get the European regulatory maze—because we’re in it with you. Our BESS is pre-certified for compliance with ENTSO-E’s Network Code on Requirements for Grid Connection, so you don’t have to spend 6 months jumping through bureaucratic hoops.

And because we manufacture in Poland (hello, EU supply chain!), lead times are just 8 weeks—half the time of our Asian competitors. No more waiting for containers to cross the Pacific while market opportunities pass you by.

Last month, a client in France texted me (yes, we’re that accessible) to say their Maxbo BESS made €12,000 in one week by bidding into FFR and spot markets. That’s not a fluke—that’s the system working as designed. Another client in Sweden cut their ROI from 4 years to 2.8 years by using our arbitrage tools.

Curious to see how it works for you? Head to www.maxbo-solar.com to request a demo. We’ll even throw in a free market analysis for your region—because in 2025, the best BESS partners don’t just sell you a container; they help you profit from it.