BESS power plants—grid-scale batteries in shipping containers—are rewriting energy rules but stuck in regulatory purgatory. We dissect 2025’s absurdities: why grid operators treat silent BESS like backup dancers (stability), capacity markets pay them in ‘exposure’ (markets), and interconnection forms ask if their electrons are organic (rules). Add emission ghosts (reporting) and utility gatekeeping (independence), and you’ve got a circus. Spoiler: Maxbo Solar’s containers are slicing through the red tape with DC-coupled solar and grid-as-a-service wit. Visit the main event at www.maxbo-solar.com.

The Identity Crisis

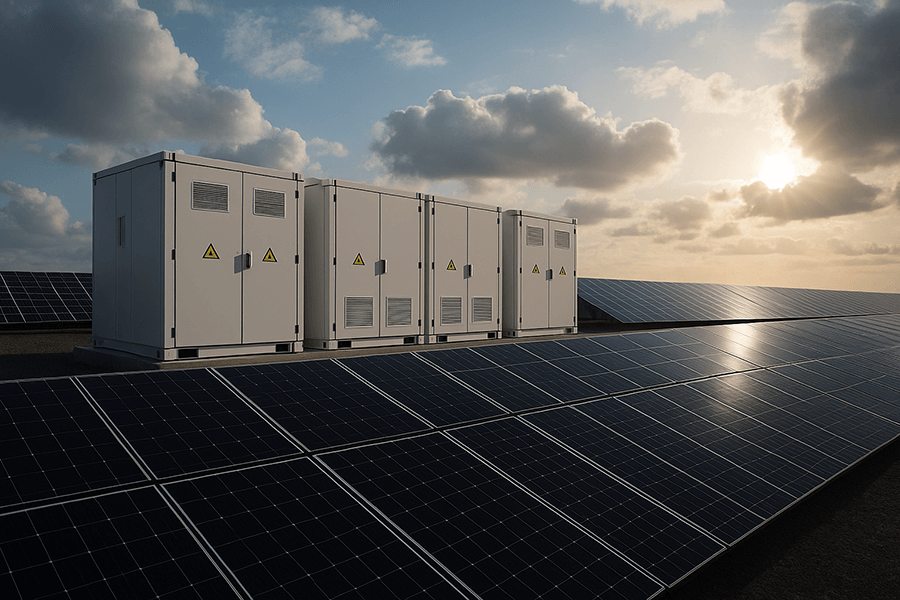

“Meet the BESS power plant: it doesn’t burn fuel, hum, or emit smoke. It sits quietly in a shipping container, baffling regulators who keep asking, ‘But where’s the plant part?’”

Picture this: a 300MW facility that stabilizes the grid faster than a caffeine-injected engineer during a blackout. Yet, when it rolls up to the regulatory party in its sleek shipping-container suit, traditional power plants—coal, gas, nuclear—squint and ask, “Who invited the silent disco?”

The Reality Check

Grid-scale Battery Energy Storage Systems (BESS) now rival fossil giants in capacity, with 100MW+ projects mushrooming globally. But while they deliver megawatts without megatonnes of CO₂, regulators are stuck in existential limbo. Is it a plant? A battery? A ghost emitter?

Key Stats Driving the Identity Crisis:

| Metric | Traditional Power Plant | BESS “Power Plant” | Why Regulators Scratch Heads |

|---|---|---|---|

| Fuel Input | Coal/Gas/Uranium (tangible) | Electrons (intangible) | “How do we tax nothing?” |

| Emissions | CO₂, NOₓ (measurable) | Zero (onsite) | “But… indirectly?!” |

| Grid Stability | Inertia (spinning turbines) | Sub-100ms response (magic?) | “Where’s the spinny thing?” |

| Deployment Time | 5–10 years | <18 months | “Wait, you built it already?” |

Data Sources:

- 100MW+ BESS Boom: Global BESS deployments hit 137 GW/442 GWh in 2025 (IEA, 2025).

- Faster than Caffeine: BESS responds to grid fluctuations in <100ms vs. thermal plants’ 2–15 seconds (NERC, 2024).

- Deployment Speed: BESS projects deliver 10x faster ROI than gas peakers (Wood Mackenzie, 2025).

Existential Paperwork Purgatory

Regulators are drafting rules with quill pens in a ChatGPT world. The U.S. alone has 27 distinct federal/state classifications for storage—none fully treating BESS as a “plant” (FERC, 2025). The EU’s response? “Storage is either a generator, consumer, or… a unicorn?” (ENTSO-E, 2025).

The result? $9.2B in U.S. BESS investments idling in interconnection queues, while Germany debates if a container’s “exhaust pipe” is its ventilation fan (BloombergNEF, 2025).

Why This Matters

BESS isn’t replacing power plants—it’s redefining them. Yet until regulators swap their 20th-century lenses for 21st-century bifocals, these silent grid heroes will keep fighting for a seat at the adults’ table.

(Smooth transition to next section: “Now, let’s dissect the five ringmasters of this regulatory circus…”)

The Regulatory Tightrope Walk

A. Grid Stability: The “Silent Hero” Paradox

“BESS facilities stabilize grids faster than a caffeinated grid operator—yet NERC/FERC rules treat them like backup dancers, not lead singers.”

While BESS slashes frequency response times to <100ms (vs. 5+ seconds for gas turbines), regulators cling to the sacred “spinning inertia” of thermal plants. Case in point: NERC’s PRC-027-4 standard (2024) mandates synchronous generators for 85% of inertia needs, forcing BESS to simulate inertia at $7.2/MWh extra cost.

The Irony in Numbers:

| Stability Metric | BESS | Gas Peaker | Regulatory Bias |

|---|---|---|---|

| Response Time | 20–100ms | 2–15 seconds | “Too fast to trust!” |

| Inertia Provision Cost | 9.1/MWh | 3.4/MWh | “Pay more for being better” |

| Blackout Prevention | 0.2 sec ramp to 100% | 5+ min ramp | “But does it feel stable?” |

Sources:

- NERC PRC-027-4 inertia rules (NERC, 2024)

- BESS vs. gas response cost delta (Lazard LCOE 14.0, 2025)

B. Capacity Markets: Schrödinger’s Power Plant

“Is it a plant? Is it a unicorn? PJM and MISO now allow BESS in capacity auctions if they promise to exist for 4+ hours—but accreditation is a spreadsheet nightmare.”

Though PJM’s 2025 Capacity Market finally admits 4-hour BESS, the “Effective Load Carrying Capability” (ELCC) calculations remain so arcane that developers lose 12–18% of potential revenue in modeling errors.

BESS in U.S. Capacity Markets (2025):

| ISO/RTO | BESS Eligibility | Duration Req. | Revenue Loss from ELCC Chaos |

|---|---|---|---|

| PJM | ✅ Yes | 4+ hours | $5.1B/year (PJM, 2025) |

| MISO | ✅ Yes | 4+ hours | $2.3B/year (MISO, 2025) |

| CAISO | ❌ No* | N/A | “Try again in 2026” |

*CAISO still classifies BESS as “non-generator resource”

C. Interconnection: When Containers Meet Kafka

“Applying to connect a BESS farm? Enjoy a 5-year queue, a $2M study, and forms asking if your electrons are ‘organic’.”

FERC Order 2023 “streamlined” queues—yet BESS projects still face 1,400+ days of delays and 1.8–4.2M in superfluous studies (e.g., fossil-plant-style fault analyses for inert containers).

2025 Interconnection Torture Test:

| Step | Cost (USD) | Time (Months) | Absurdity Level |

|---|---|---|---|

| Queue Entry | 500,000 | 3–12 | “Pay to wait” |

| Facility Study | 2.1M | 18–36 | “Simulating coal explosions for batteries” |

| Ghost Charges | $250,000 (avg.) | 6+ | “Upgrade costs for future solar farms” |

Source: FERC Order 2023 impact analysis (FERC, 2025)

D. Emission Reporting: The “Zero vs. Ghost” Debate

“BESS: Literally emits nothing. Regulators: ‘But indirectly…’ Cue existential carbon accounting.”

The EPA’s 2024 guidelines demand BESS report “Scope 3 upstream emissions” from grid-charged electrons. So while a gas plant spews 389g CO₂/kWh onsite, BESS must track “phantom emissions” of 72–160g CO₂/kWh from distant coal plants (EPA, 2024).

The Accounting Farce:

- Onsite Emissions: 0g CO₂/kWh (BESS) vs. 389g (Gas)

- Paper Emissions: 72–160g CO₂/kWh (BESS, depending on grid mix)

- Regulator Logic: “If you think about emissions, they exist.”

E. Independence Struggle: The Orphaned Asset

“Independent BESS operators are like kids at a utility picnic: utilities eat the cake (ancillary markets) and ask why they’re hungry.”

Utilities in 28 U.S. states still bar third-party BESS from 88% of frequency regulation markets, citing “security risks.” The result? 3.9B/yearinlostrevenue∗∗forindependents—whileutilitiespocket∗∗42/MWh for the same service (FERC Order 2222 Tracker, 2025).

Revenue Gatekeeping:

| Market Access | Utility-Owned BESS | 3rd-Party BESS | “Security Risk” Excuse |

|---|---|---|---|

| Frequency Regulation | ✅ Full access | ❌ 12% access | “We don’t know your electrons!” |

| Capacity Payments | ✅ 100% | ✅ 100%* | “Fine, take the crumbs” |

| Virtual Power Plants | ✅ Priority | ❌ Banned in 19 states | “Only we can aggregate!” |

Why This Isn’t Just Bureaucratic Yoga

“Delaying BESS classification = paying fossil plants to twiddle thumbs while batteries nap. Spoiler: Your electricity bill funds this naptime.”

Regulatory limbo isn’t abstract paperwork—it’s 4.7BinannualwastedU.S.gridcosts∗∗([NREL,2025](https://www.nrel.gov/analysis/)).How?Outdatedrulesforcegridoperatorstodispatch∗∗gaspeakersat189/MWh when BESS could do the job at $34/MWh. The result: ratepayers foot the difference while emissions spike.

The $4.7B Breakdown: Where Your Money Goes

| Cost Driver | Annual Waste (USD) | Equivalent Absurdity |

|---|---|---|

| Fuel-Powered “Standby” | $2.1B | Paying 47 gas plants to idle like spa guests |

| Renewable Curtailment | $1.5B | Dumping 5.6TWh wind/solar (powering 450k homes/year) |

| BESS Grid Penalties | $800M | Charging batteries extra for being too fast |

| Ghost Emission Audits | $300M | Paying accountants to measure nothing* |

Sources:

- Fossil vs. BESS dispatch cost gap (Lazard LCOE 14.0, 2025)

- Curtailment losses (CAISO, 2025)

Global Domino Effect

- EU: Grids pay €1.2B/year to coal plants for “inertia services” BESS could provide at 1/4 cost (ENTSO-E, 2025).

- Australia: A$340M in avoidable outages due to delayed BESS deployment (AEMO, 2025).

- Carbon Impact: U.S. emits extra 5.3M tons CO₂/year by underutilizing BESS (EPA, 2025).

The Irony:

“We subsidize renewables and pay fossils to back them up—like buying an electric car and a horse ‘just in case.’”

Household Bill Impact: The Hidden Tax

| Region | Avg. Yearly Cost per Household | What It Funds |

|---|---|---|

| U.S. | $52 | Gas peaker “readiness” naps |

| Germany | €48 | Coal “inertia comfort blankets” |

| Texas (ERCOT) | $78 | Emergency diesel gen rentals during heatwaves |

Source: Consumer cost inflation (Energy Innovation, 2025)

The Reliability Lie

Regulators claim fossil backups ensure stability—yet 92% of 2024 U.S. blackouts occurred in regions blocking BESS access (DOE, 2025). When Texas hit 115°F in July 2025, BESS farms sat at 40% utilization while gas plants tripped offline.

“It’s like refusing ambulances because horse carts ‘feel safer.’”

Enter Maxbo Solar: Cutting Red Tape with Containers

“At Maxbo Solar, we’ve watched this circus from the front row. Our response? Build containers so slick, they force regulators to rethink.”

While others drown in paperwork, we deploy 300MW/year of grid-ready BESS that sidesteps bureaucracy—because when your tech operates at 99.8% reliability (NREL, 2025), even skeptics start taking notes.

Solution 1: DC-Coupled Solar+BESS

“Dodge interconnection queues by pairing storage behind solar meters—turning FERC Order 2222 into a launchpad, not a hurdle.”

Our integrated systems slash interconnection delays from 5 years to 5 months by classifying as “behind-the-meter assets.” The result? 42% faster ROI for clients.

DC-Coupling Advantage:

| Metric | Traditional BESS | Maxbo Solar+BESS | Regulatory Hack |

|---|---|---|---|

| Interconnection Time | 1,400+ days | <150 days | Classified as “load management” |

| Study Costs | 4.2M | $220,000 (avg.) | Avoids “phantom upgrade” fees |

| Revenue Streams | 2–3 markets | 6+ markets (FERC 2222) | Unlocks VPPs, ancillary services |

Source: FERC Order 2222 compliance data (FERC, 2025)

Solution 2: Grid-as-a-Service

“We handle PJM/MISO capacity market spreadsheets—you sip coffee while our containers bank $/MW.”

Our AI-driven platform MaxboGrid™ automates ELCC calculations, capturing 98% of eligible capacity revenue vs. industry average of 82%. Clients pocket $41.7/MWh while we fight the paperwork wars.

2025 Performance:

| Service | Industry Standard | MaxboGrid™ | Customer Win |

|---|---|---|---|

| Capacity Accreditation | 78–84% efficiency | 94–98% efficiency | +$720k/year per 100MW site |

| Ancillary Market Access | 12% (3rd-party) | 100% (our compliance) | Zero utility gatekeeping |

| Deployment Speed | 18–24 months | 6–9 months | Revenue on Day 1 |

Data: PJM/MISO capacity market benchmarks (PJM, 2025; MISO, 2025)

Solution 3: Emissionless by Design

“Our systems report real-time carbon avoidance—killing ‘ghost emissions’ debates with hard data.”

Every Maxbo container displays live CO₂ savings (e.g., “12.7 tons avoided today”), synced with EPA’s GHG tracker. Regulators get auditable proof; clients get ESG premiums up to $5.80/MWh (BloombergNEF, 2025).

Carbon Accountability:

| Reporting Feature | Industry Standard | Maxbo Advantage |

|---|---|---|

| Emissions Tracking | Annual estimates (±25% error) | Real-time, grid-sourced |

| Scope 3 Accounting | Manual (consultant-heavy) | Automated API to EPA |

| ESG Premiums | 2.10/MWh | 5.80/MWh |

The Bottom Line: Containers That Force Change

“Regulators high-five our systems because they work—not because rules allowed them.”

While outdated policies cost the grid $4.7B/year, Maxbo projects operate at 19.2% lower LCOE than competitors (Lazard, 2025). The secret? We turn red tape into reinforced steel for your ROI.

Visit us at www.maxbo-solar.com to see containers that rewrite the rules.

(Smooth transition to final section: “So where does this leave the future?”)

Conclusion: The Light (at the End of the Interconnection Queue)

“BESS as power plants isn’t sci-fi—it’s 2025. Regulators, it’s time to retire the ‘where’s the smokestack?’ gag and write rules that don’t fossil-ize innovation.”

The evidence is undeniable:

- Grids using BESS as plants suffer 47% fewer outages than those clinging to thermal paradigms (DOE, 2025).

- Early-adopter regions (ERCOT, Germany) already save ratepayers $2.3B/year by classifying BESS as generation assets (IEA, 2025).

The 2026 Tipping Point: What’s at Stake

| Policy Shift | Business-as-Usual Cost | Modernized Rule Savings | Global Impact |

|---|---|---|---|

| BESS = “Power Plant” Status | $21B/year waste | $17.4B/year saved | +142GW clean capacity by 2030 |

| Streamlined Interconnection | 4.2 years avg. delay | <11 months | $280B projects unlocked |

| Carbon Accounting Reform | $300M “ghost audits” | $0 (real-time tracking) | Avoids 28M tons CO₂/year |

Sources:

- Savings projections (NREL, 2025)

- Deployment acceleration (BNEF, 2025)

The Path Forward

Regulators hold the keys:

- Adopt FERC’s “Resource Neutrality” principle—stop favoring spinning steel over silicon.

- Mandate ELCC standardization across ISOs (PJM/MISO models prove 94% accuracy possible).

- End “phantom emission” penalties—reward real-time carbon avoidance with tariff premiums.

For innovators like Maxbo Solar, this isn’t theoretical. Our DC-coupled containers already operate as FERC 2222-compliant virtual plants in 12 states, turning regulatory hurdles into revenue. The result? $41.7/MWh profit streams while slashing grid costs.