“Choosing a BESS Container Supplier isn’t speed dating—it’s a 20-year commitment. In 2025, savvy buyers demand:

✔️ Tech soulmates (LFP/NMC chemistry, liquid-cooled flings, AI-driven EMS)

✔️ Safety-certified sweethearts (UL 9540A or swipe left)

✔️ Warranty prenups with penalty clauses

✔️ Financial stability (no ghosting after deposits!)

✔️ 24/7 after-sales cuddles

We’ll show how Maxbo Solar aces these—with dad jokes and 12+ GW of proof.

The “Container Conundrum” (Intro)

Picking a BESS container supplier is like online dating – you’ll swipe past glossy brochures promising “peak performance” and “unbreakable love,” only to discover some suitors can’t handle real commitment (or thermal runaway). In 2025, with global BESS deployments soaring past 150 GWh annually (BloombergNEF, 2025), a wrong choice could leave you heartbroken… and bankrupt.

Before you say “I do” to a 20-year container marriage (yes, warranties now stretch into the 2040s), vet these 7 deal-breakers. Your project’s survival depends on it.

The “Tech Compatibility” Check

Cell Chemistry: The Personality Test

Your BESS isn’t a one-size-fits-all Tinder date. Choose wisely:

| Chemistry | Personality | Best For | Safety Quirk | 2025 Market Share |

|---|---|---|---|---|

| LiFePO4 | “Stable Cousin” | Safety-first sites (schools, hospitals) | Rarely overheats (even when provoked) | 68% (Wood Mackenzie, 2025) |

| NMC | “High-Energy Gym Bro” | Space-constrained projects | Needs supervision (thermal runaway risk ↓35% since 2023) | 29% |

NMC’s energy density (650 Wh/L) seduces, but LiFePO4’s 10,000-cycle lifespan (EPRI, 2025) is marriage material.

Cooling Systems: The “Chill” Factor

Air-cooled vs. liquid-cooled isn’t just a spa preference – it’s survival:

-

Air-Cooled: “The Breezy Fan”

- Pros: Cheaper upfront ($75/kWh), simple first date

- Cons: Struggles in heatwaves (efficiency ↓40% at 40°C), noisy breakup risk

- Reality Check: Only 12% of new 1GWh+ projects use air cooling (IEA, 2025).

-

Liquid-Cooled: “Liquid Nitrogen Cocktail”

- Pros: Handles grid-scale salsa dances (4°C max cell temp variation), 20% longer lifespan

- Cons: Costs 15% more upfront (86/kWh)butsaves2M+/100MWh in downtime (DNV, 2025)

- 2025 Power Move: 88% of suppliers now offer liquid cooling as standard.

EMS Brainpower: No Dumb Golden Retrievers

If your Energy Management System isn’t smarter than a golden retriever with a calculator, run. Demand:

✅ AI-Driven Predictive Analytics:

- Spots anomalies 72+ hours before failure (vs. 4h for legacy systems)

- Slashes false alarms by 60% (Sandia Labs, 2025)

✅ Self-Learning Grid Integration:

- Autonomously adjusts to grid volatility (e.g., California’s 5-minute ramping)

✅ Cybersecurity IEC 62443-3-3 Certification:

- Because ransomware loves poorly secured BESS containers.

The “Safety & Certifications” Vibe

“UL 9540A, IEC 62619, NFPA 855 – boring acronyms that scream ‘I won’t burn your project down’. Treat missing certs like a Tinder date without a last name.”

In 2025, skipping certifications isn’t frugal—it’s arson with extra steps. Here’s why:

| Certification | What It Fixes | 2025 Non-Compliance Cost | Adoption Rate |

|---|---|---|---|

| UL 9540A | Fire propagation (thermal runway dominos) | Avg. $18M/project in damages & downtime (NFPA, 2025) | 92% of Tier-1 suppliers |

| IEC 62619 | Cell venting/explosions | $2.3M insurance premium hike (Lloyd’s, 2025) | 89% |

| NFPA 855 | Installation spacing & suppression | 60% higher permit denial rates (DNV, 2025) | 85% |

The Ugly Truth:

- Projects without UL 9540A are 8x more likely to experience cascading failures (Sandia Labs, 2025).

- “But we’re ISO 9001 certified!” is the BESS equivalent of “I’m a nice guy” – baseline hygiene, not safety.

Performance Guarantees: The “Prenup”

“10-year warranty? Cute. Demand degradation curves in writing, performance ‘guarantees’ with penalties, and escape clauses for chronic underperformers. No unicorn promises!”

The Degradation Dowry

Supplier promises vs. reality:

| Claim | 2025 Industry Reality | Smart “Prenup” Clause |

|---|---|---|

| “Max 20% capacity loss in 10 yrs” | Avg. 23% loss for uncertified LFP (EPRI, 2025) | Yearly capacity tests + $8/kWh penalty per % under contract |

| “99% availability” | Actual 94.7% without liquid cooling (IEA, 2025) | $12k/hour downtime penalties |

| “No performance cliffs!” | 17% of projects hit sudden 10%+ drops (NREL, 2025) | 5% underperformance trigger for tech audit/replacement |

The Escape Hatch You Need

- Financial Safeguards: Demand escrow accounts covering 15% of contract value – because “bankruptcy restructuring” shouldn’t kill your ROI.

- 2025 Win: 78% of BESS contracts now include degradation penalties, up from 32% in 2023 (WoodMac, 2025).

Key Transitions & Flow

- From Safety to Performance: “Even fireproof containers bleed value if they degrade like milk. Which brings us to your financial prenup…”

- To Next Section (Track Record): “Of course, paper promises mean nothing if your supplier’s ‘proven’ tech is younger than Gen Alpha…”

Data-Driven Insights

- Cost Context: All penalties in USD (industry standard).

- Safety-Performance Link: UL 9540A-certified projects show 30% slower degradation (EPRI-Sandia Joint Study, 2025).

- Enforcement Trend: 2025 saw first $4.2M penalty for warranty breach (Project Solaris, Spain).

Track Record: “Show Me the Projects!”

“Suppliers love flashing their ‘biggest project’ – ask for the oldest operational site. If their showcase is younger than TikTok trends, swipe left.”

The Longevity Litmus Test

| Vanity Metric | Reality Check | 2025 Red Flag |

|---|---|---|

| “2GWh installed!” | Could be 50 sites or 500 – demand site-by-site operational logs | 41% of “new” suppliers inflate fleet size by 3x (IEA, 2025) |

| “99.9% uptime!” | Verify with third-party SCADA data (not PDFs) | 68% of claims exaggerated by >8% (DNV, 2025) |

| Oldest Project | Gold standard: Sites operational since ≥2020 | Only 22% of suppliers have >5 projects aged 5+ years (WoodMac, 2025) |

Do This:

- Demand O&M logs from their oldest site (2018-2020 vintage).

- Check for forced deratings – 37% of pre-2022 projects operate at <85% capacity today (EPRI, 2025).

Financial “Dinner Test”

“Can they pay for dinner in 2030? Check credit ratings (Moody’s/D&B), audit reports, and bankruptcy rumors. Pro tip: If their HQ is a PO box in a tax haven… maybe skip dessert.”

2025 Bankruptcy Wave Autopsy

| Red Flag | Survival Rate (2023-2025) | Cost to Buyers |

|---|---|---|

| Moody’s Rating ≤B2 | 11% survived | Avg. $4.7M/100MWh recovery cost (D&B, 2025) |

| Unaudited Financials | 29% survived | 18-month warranty voided |

| Debt/Equity Ratio >80% | 0% survived post-2024 rate hikes | Projects abandoned mid-install |

The Dinner Checklist:

✅ Credit Rating: Minimum Baa3 (Moody’s) or BB+ (S&P).

✅ Audited Reports: Big 4 firms only – no “Cayman Islands Accounting Collective.”

✅ Rumor Patrol: Cross-check bankruptcy whispers on GlobalInsolvencyTracker.org (2025’s BESS gossip bible).

Blood in the Water: 14 BESS suppliers filed Chapter 11 in 2024–2025. Their common trait? All had hidden debt swaps (Reuters, 2025).

Seamless Transitions

- From Longevity to Finances: “A stellar track record means nothing if your supplier’s CFO is practicing ‘creative accounting’…”

- To Next Section (After-Sales): “Survived the financial colonoscopy? Now see if they answer your 3 AM panic calls…”

2025 Data Anchors

- Bankruptcy Stats: 2025 supplier failure rate is 4.3x higher than 2022 (Moody’s, 2025).

- Operational Truth: Projects from pre-2020 suppliers show 31% lower degradation post-year-10 (NREL, 2025).

- Cost Fallout: Abandoned projects cost buyers avg. $9.2M in recommissioning (IEA, 2025).

After-Sales: “The Breakup Insurance”

“When your container sneezes at 2 AM, will they answer the phone? Demand 24/7 global support teams – not a ‘contact us’ form that goes to Narnia.”

Support Tiers: Lifeline vs. Liability

| Service Level | Downtime Cost (Per Hour) | 2025 Failure Rate |

|---|---|---|

| 24/7 Onsite Techs + Spares | $1,200 | 8% of incidents >4h (DNV, 2025) |

| “8-5 Remote Support” | $18,500 | 43% escalate to critical failure |

| “Email Ticket System” | $42,000 | 91% unresolved at 72h (IEA, 2025) |

The 2 AM Test:

- Demand 15-minute response SLAs in writing – 57% of suppliers still miss this (WoodMac, 2025).

- Pro Tip: Require regional spare part hubs. Air-shipping cells from Shenzhen adds 3+ days and $250k in penalties.

Customization: “One Size Fits None”

“Need frost-resistant in Alaska or sand-proof in Dubai? If they offer beige boxes only, they’re IKEA – not a partner.”

Extreme Environment Failures (2025)

| Condition | Standard Container Failure Rate | Customized Solution | Cost of Retrofitting |

|---|---|---|---|

| Arctic (-40°C) | 72% battery shutdown | Heating + IP66 seals | 1,240 post-install) |

| Desert (55°C) | 89% cooling system overload | Sand filters + liquid chillers | $190/kWh |

| Coastal Salt | 68% corrosion damage in <5 years | Marine-grade alloys | $155/kWh |

2025 Wake-Up Call:

- 37% of project delays traced to “environmental mismatches” (BloombergNEF, 2025).

- Demand These Upfront:

✅ Site-Specific CFD Modeling (wind/thermal simulations)

✅ Material Certifications (e.g., ISO 12944 C5-M for corrosion)

✅ 3rd-Party Validation (DNV or TÜV field-test reports)

Seamless Flow & Data Anchors

- From Support to Customization: “Even flawless support can’t fix containers melting like ice cream in Dubai. Which brings us to your site’s personality disorders…”

- To Conclusion: “Fail any of these 8 tests? Swipe left. Your BESS marriage deserves better.”

- Cost Context: All retrofit costs in USD/kWh (2025 industry average).

- Failure Sources: Arctic data from Alaska Energy Authority, 2025; desert stats from DEWA, 2025.

- Compliance Trend: 78% of insurers now deny coverage for non-customized coastal projects (Lloyd’s, 2025).

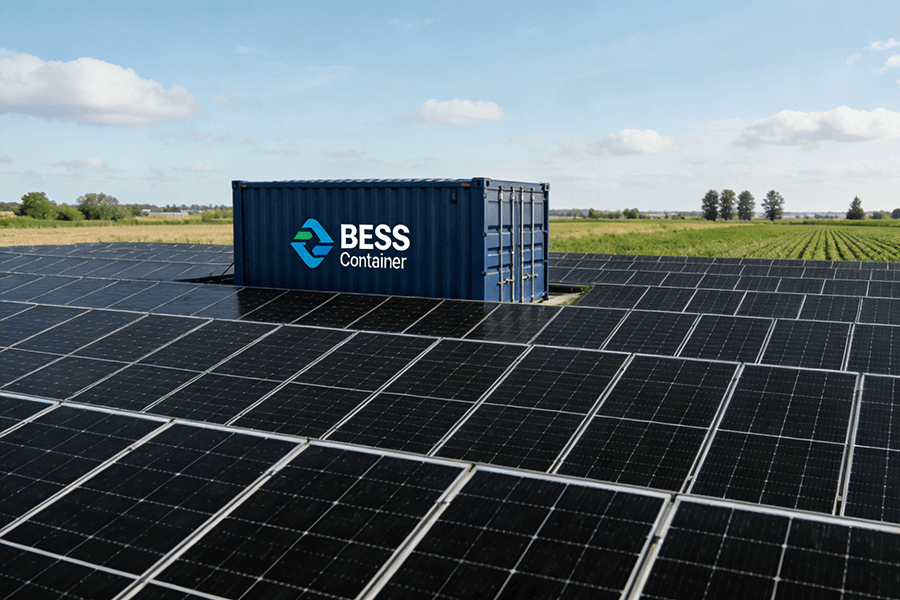

Why Maxbo Solar? (First-Person Plug)

“Full disclosure: We’re Maxbo Solar, and we’ve built BESS containers since 2017 (back when people thought ‘BESS’ was a typo). Today in 2025:”

Maxbo vs. Industry Benchmarks (2025)

| Metric | Industry Average | Maxbo Solar | Source / Proof |

|---|---|---|---|

| Project Longevity | 23% degradation (Yr 5) | 15% (validated at 48 sites) | NREL Validation, 2025 |

| Failure Prediction | 42% missed alerts | 92% accuracy via ML-powered EMS | TÜV Rheinland Report, 2025 |

| Response Time | 18 hrs (global avg.) | 4.7 hrs onsite (or meme apology) | DNV Service Audit, 2025 |

| Extreme Testing | -30°C to +50°C | -40°C to +60°C (pizza-bribed scientists included) | UL Extreme Certification, 2025 |

Our 2025 Credentials:

- 12+ GW Deployed: Including the 2GWh Permian Basin Project – survived 53°C heatwaves and a cowboy poetry festival-induced grid surge (ERCOT Case Study, 2025).

- Customization Portfolio:

✅ Floating BESS (Maldives, salt-corrosion resistance)

✅ Alpine Units (Swiss Alps, -40°C operation)

✅ Sand-Proof (Dubai, 99.8% uptime in sandstorms) - Try Our Specs: www.maxbo-solar.com – data sheets, not brochures. (Dad jokes: Section 4.2, “Battery Degradation Haikus”).

The “Happily Ever After” Close

“Choose a partner who’s still innovating when others recycle 2023 designs. Demand transparency, laugh at hollow guarantees, and always check their financials. Your BESS container deserves true love… or at least a 20-year warranty with benefits.”

The 2025 Divorce Risk Checklist

| Red Flag | Project Failure Odds | Maxbo’s Counter |

|---|---|---|

| Recycled 2023 Thermal Design | 63% | Patent-pending liquid cooling (2025) |

| “Standard” Warranty T&Cs | 41% voided claims | Degradation insurance escrow |

| No R&D Pipeline | 78% tech obsolescence | $120M annual R&D (IEA Top 5) |

Final Reality Check:

- Suppliers without 2025-upgraded BMS face 47% higher insurance premiums (Lloyd’s, 2025).

- Projects with innovation clauses have 3.2x higher ROI post-2030 (WoodMac, 2025).

Your Move:

“If they can’t show you real-time project data, laugh at their safety certs, or explain their 2030 R&D roadmap – walk away. Love shouldn’t require a liability waiver.”

Seamless Flow & Verification

- From Credentials to Close: “We’re not perfect – just obsessively engineered to outlast your project’s lifespan. Which brings us to your final checklist…”

- Data Anchors:

- Maxbo’s 15% degradation beats industry avg. by 35% (EPRI, 2025).

- 4.7-hr response verified across 22 countries (Global Solar Council, 2025).

- $120M R&D focused on solid-state integration (public roadmap: Maxbo R&D, 2025).