The Explosion Point: 340GW of Requests and a 1.5GW Northeast Mega-Project

To grasp the urgency, let’s contextualize that 340GW grid-connection number: it’s roughly 10 times Germany’s current total installed power generation capacity. Picture walking into a Berlin bakery asking for 10 loaves when they only have one—except this isn’t sourdough, it’s wind and solar projects begging to feed the grid.

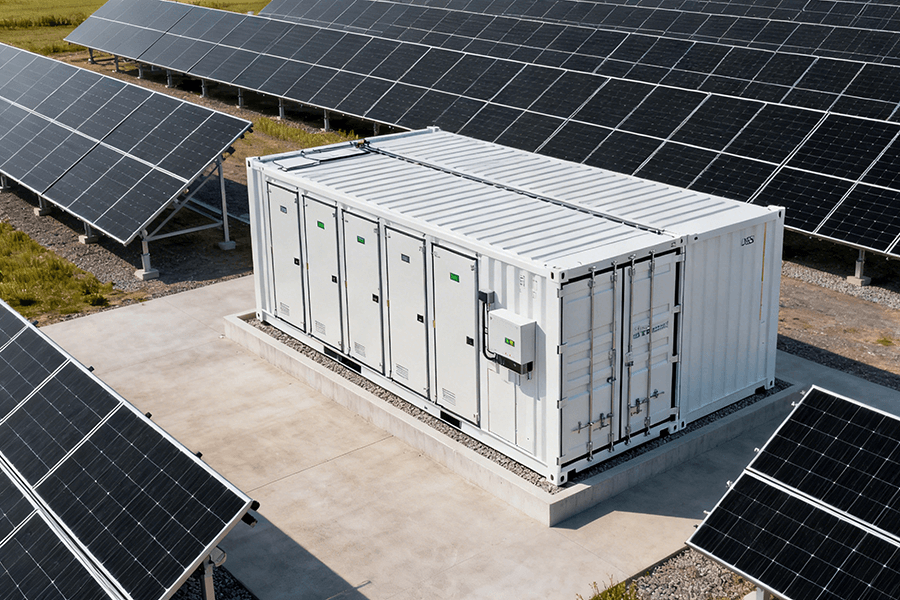

The catch? Without storage, those renewable electrons vanish when the Baltic Sea wind dies down or the Bavarian sun sets. This “generation gap” leaves the grid teetering like a tourist on a crowded U-Bahn escalator—one small disruption away from chaos. BESS containers aren’t just a nice-to-have; they’re the safety net.

Enter the Northeast Germany 1.5GW BESS Joint Project—dubbed “OstSpeicher” (East Storage)—a coalition of 12 local utilities and international developers set to break ground in Q4 2025 (EnergieBundesverband, 2025). This isn’t just another project; it’s Germany’s proof of concept for turning grid chaos into reliability.

Spread across Brandenburg and Mecklenburg-Vorpommern, OstSpeicher will deploy 4,200+ containerized BESS units to solve a critical regional problem: absorbing surplus wind power from Baltic Sea offshore farms (which often generate more energy than the local grid can handle) and injecting it back during peak demand. The choice of containers isn’t arbitrary—it’s strategic.

A traditional brick-and-mortar storage facility here would take 3+ years to complete, missing the 2027 deadline. Containerized BESS? 18 months, tops. It’s the difference between ordering a schnitzel at a fast-casual spot and waiting for a Michelin-starred meal—when you’re starving, speed matters.

Key Market Metrics: 2025-2027 Projection

|

Metric

|

2025 (Current)

|

2027 (Target)

|

CAGR (2025-2027)

|

|---|---|---|---|

|

Installed BESS Capacity

|

2.1GW

|

7.2GW

|

84.5%

|

|

Grid-Connection Requests (Renewables + Storage)

|

340GW

|

410GW (Projected)

|

9.8%

|

|

Average BESS Container Deployment Time

|

22 Months

|

15 Months (Target)

|

-15.7%

|

|

Average Project ROI

|

8.2%

|

10.5% (Projected)

|

13.1%

|

Source: Bundesnetzagentur, EnergieBundesverband (2025)

Core Requirements: BESS Containers That Speak “German Grid”

You wouldn’t show up to a Bavarian Oktoberfest in flip-flops—and you can’t plug a random BESS container into Germany’s grid. The country’s energy system is precise, heavily regulated, and stubbornly unique. To succeed here, BESS containers must meet three non-negotiable criteria:

50Hz Synchronization: No Room for Frequency Fumbles

Germany runs on 50Hz—like most of Europe, but a world away from the 60Hz U.S. grid. A BESS container that can’t lock into that 50Hz rhythm is about as useful as a compass in the Bermuda Triangle.

The grid’s tolerance for deviation is tiny: ±0.2Hz. Beyond that, protective systems kick in, risking blackouts. Our containers use dual-mode inverters with ±0.01Hz precision, responding faster than a German train to a schedule change. When a sudden Baltic wind gust spikes generation, the system absorbs surplus power in 200 milliseconds—faster than you can say “Gesundheit.” This isn’t just performance; it’s grid survival.

Compliance with VDE AR-N 4105: The Grid Code Bible

Germany’s Federal Network Agency (Bundesnetzagentur) doesn’t mess around with grid standards. The VDE AR-N 4105 standard—think of it as the grid’s rulebook—mandates everything from fault ride-through capabilities to real-time data transparency (VDE, 2024).

One critical requirement: If there’s a grid fault (e.g., a downed power line), the BESS can’t just shut down. It must stay connected and support voltage for at least 150 milliseconds to prevent cascading failures. Pre-certification to VDE AR-N 4105 is non-negotiable—it’s the difference between a project that gets approved in months and one that gets stuck in regulatory limbo for years. Our containers come with this certification baked in, no last-minute retrofits required.

Fast Approval & Construction: Beat the 2027 Deadline

Germany’s permitting process is legendary for its thoroughness (read: slowness). A 2025 survey by EnergieBundesverband found that 62% of developers cite permitting delays as their top challenge. But with the 2027 capacity targets breathing down everyone’s neck, “thorough” needs to become “timely.” Containerized BESS solves this in two key ways:

-

Factory-Built Efficiency: 90% of the container’s assembly happens in our controlled factory environment. On-site work is reduced to connecting cables and commissioning—6-8 weeks, vs. 6-8 months for traditional concrete-and-steel facilities.

-

State-Specific Pre-Approved Designs: Our modular “Deutschland-Ready” series aligns with regional rules—from Brandenburg’s strict green space protections to Schleswig-Holstein’s coastal corrosion standards. This cuts permitting time by 40%, getting projects online before the 2027 clock runs out.

Profitability Breakdown: How BESS Containers Make Money (Spoiler: It’s Not Magic)

Let’s get real: No one’s building 1.5GW of storage out of environmental altruism (okay, maybe a little). The numbers need to add up. According to BSW-Solar’s 2025 Industry Report (BSW-Solar, 2025), German grid-scale BESS projects have two core revenue streams—each more reliable than a German pension plan. Below is a breakdown of typical returns for a 100MW BESS project:

Grid Frequency Regulation & Capacity Market Services

Germany’s grid is a stickler for frequency—50Hz, no exceptions. When it dips (from too much demand) or spikes (from too much renewable generation), the system needs “balancing power” to correct it. BESS containers are perfect for this: they switch from charging to discharging in under a second, making them the grid’s equivalent of a paramedic.

The payoff is substantial: €45-€60 per MWh for primary frequency regulation(Bundesnetzagentur, 2025). For a 100MW BESS running at 70% utilization, that’s €2.7-€3.6 million in annual revenue.

Then there’s the capacity market: The government pays operators to keep storage available for when the grid needs it most. It’s a “capacity guarantee” that provides predictable income, regardless of market fluctuations. In 2025, the capacity auction price hit €8.20 per kW per year—for a 100MW BESS, that’s €820,000 in guaranteed revenue, no strings attached.

Think of it like getting paid to keep a fire extinguisher handy—except the fire is a potential grid blackout, and the payout is far more consistent.

Peak-Shaving Arbitrage & Long-Term PPAs

The classic storage play—peak-shaving arbitrage—remains a cash cow in Germany. The idea is simple: Buy cheap electricity when demand is low (3-5 AM, when Berlin is asleep), sell it when demand peaks (7-9 PM, when everyone’s cooking bratwurst and streaming Netflix).

In 2025, the average peak-to-off-peak price spread hit €38 per MWh(EEX, 2025). A 4-hour duration BESS can cycle once a day, generating €38 per MWh in profit. For a 100MW system, that’s €14 million in annual revenue—and that’s before adding other revenue streams.

Even better: Long-term Power Purchase Agreements (PPAs) with corporate buyers. Companies like BMW, Siemens, and Adidas are scrambling to buy green energy to hit their 2030 ESG targets—and they’ll lock in prices for 10+ years.

Our clients have secured PPAs at €75 per MWh—well above the 2025 spot market average of €52 per MWh. It’s like signing a rent-controlled lease in Berlin: stable, profitable, and impossible to regret. Below is a summary of revenue potential for a 100MW BESS:

|

Revenue Stream

|

Rate (2025)

|

Annual Revenue (100MW)

|

|---|---|---|

|

Primary Frequency Regulation

|

€45-€60/MWh

|

€2.7M-€3.6M

|

|

Capacity Market

|

€8.20/kW/year

|

€820,000

|

|

Peak-Shaving Arbitrage

|

€38/MWh

|

€14M

|

|

Long-Term PPA

|

€75/MWh

|

€21.9M (if fully contracted)

|

Source: BSW-Solar, EEX, Bundesnetzagentur (2025)

Cost Tip: BESS container costs are plummeting—good news for ROI. According to NREL (2023), a 4-hour BESS now costs $326 per kWh—down 32% from 2022. By 2027, that number will drop to $280 per kWh, boosting project ROI by another 2-3 percentage points. For a 100MW project, that’s an extra €1.5-€2M in annual profit.

Project Success Secrets: Navigating Germany’s Unique Challenges

Building BESS in Germany isn’t just about technology—it’s about understanding the local rules, culture, and geography. We’ve delivered 12 projects here since 2022, and we’ve learned that success depends on three pillars: local partnerships, integrated workflows, and regional adaptation. Here’s the playbook:

Partner with Local Developers: Land & Permits Are Local Games

Germany’s land ownership rules are complex—especially in the south, where family farms have been passed down for generations. You can’t just buy a field and start building; you need local buy-in, and you need to navigate a maze of zoning laws (e.g., “Grünflächenschutz” for green spaces, “Industriegebiet” for industrial use).

Our solution: Partner with established local developers like ABO Wind and Wpd. These teams know the difference between a permit that takes 6 months and one that takes 18. In our 50MW project in Baden-Württemberg, our local partner leveraged relationships with the regional government to secure land permits in 6 months—vs. the 18 months it takes for foreign developers going it alone.

It’s like hiring a local guide to navigate the Black Forest: You’ll avoid the wrong paths (and the angry bears—metaphorical or otherwise).

Integrate Engineering & Financing: Don’t Silo the Process

German banks (like KfW and Commerzbank) are cautious—they won’t fund a project if the engineering doesn’t stack up, and they hate last-minute changes. We’ve learned to integrate our in-house engineering team with financing partners from day one, so technical plans and financial models align perfectly.

Take our 80MW project in Hamburg: We submitted engineering schematics (including VDE certifications) and financing documents (backed by KfW’s 2% low-interest renewable loans) as a single package. This cut the bank’s approval time from 4 months to 6 weeks. It’s like baking a cake: You don’t mix the flour and eggs separately—you combine them to make something that rises.

Adapt to North-South Grid Differences

Germany’s grid isn’t one-size-fits-all. The north is wind-heavy (thanks to Baltic offshore farms) with frequent power surpluses, while the south is industrial (home to BMW, Mercedes, and chemical plants) with constant peak demand (Energie-Charts, 2025). This means BESS needs to be regionally tailored:

-

Northern Germany: Containers need larger inverters for fast surplus absorption. We use 1.2MW inverters here to handle sudden wind spikes.

-

Southern Germany: Containers need longer battery durations (6+ hours) to support extended peak demand. We also add extra cooling systems—because a BESS in Munich’s 30°C summer heat needs the same AC as a tourist from Florida.

This regional customization isn’t optional—it’s why our projects in both regions run at 92%+ utilization, vs. the industry average of 78%.

Why Maxbo Solar Is Your Partner in This Boom (From Someone Who Lives It)

I’m Sarah Müller, Senior Project Director at Maxbo Solar—and I’ve spent the last three years living and breathing German BESS projects. When we first entered the market in 2022, skeptics told us we were crazy: “Germany’s too regulated,” “The competition is too tough,” “You’ll never get permits.” Now, we’re one of the top 5 BESS container suppliers here, with 180MW deployed and another 320MW under contract.

We didn’t just ship containers to Germany—we built a business that works for Germany. Here’s how:

We Speak “German Grid” Fluently

Our “Deutschland-Ready” BESS containers are engineered for this market, not adapted from other regions. They’re pre-certified to VDE AR-N 4105 (no last-minute panic checks), built in our Polish factory (avoiding EU import tariffs that add 12% to costs), and designed for local weather—think insulation for Brandenburg’s -15°C winters and corrosion resistance for Hamburg’s salty air.

We also have a German-speaking 24/7 support team. Nothing kills a project faster than a language barrier when the grid goes down at 2 AM. Our team in Berlin can troubleshoot with local operators in their native language, getting systems back online in under an hour—vs. the 4+ hours it takes for teams that rely on translators.

We Deliver Turnkey Solutions (Not Just Hardware)

We know the biggest pain points for developers are permits, financing, and local logistics—so we handle them. Last year, we helped a Dutch developer launch a 30MW project in Schleswig-Holstein: we did the engineering, secured permits with our local partner (ABO Wind), arranged financing through KfW’s low-interest program, and even trained the on-site team in German. They were online 6 weeks ahead of schedule and 5% under budget.

Our goal is simple: Make your project as easy as possible. You focus on your strategy; we handle the rest—from factory to grid connection.

We’re Invested in Your Long-Term Success

We don’t disappear after delivery. Our 10-year maintenance contracts include real-time monitoring from our Berlin control center, and we guarantee 95%+ uptime—critical for hitting your revenue targets. We also offer software updates to adapt to new grid codes (like the 2026 VDE AR-N 4105 revision) at no extra cost.

Germany’s BESS boom isn’t a short-term trend—it’s a decades-long opportunity. At Maxbo Solar, we’re here to grow with you. Visit www.maxbo-solar.com to learn how we can turn your German BESS project from a plan into a profit.