Introduction

In the dynamic and rapidly evolving landscape of renewable energy, lithium iron phosphate (LFP) batteries have emerged as a revolutionary technology, particularly pivotal for solar farms. Take, for instance, StarCharge’s cutting-edge 314Ah cells. These remarkable energy storage units demonstrate exceptional durability and performance, maintaining an impressive 85% capacity retention even after 5,000 charge-discharge cycles. To put this into perspective, it’s akin to a world-class marathon runner completing 5,000 grueling races while still retaining 85% of their original speed and endurance. Such longevity significantly reduces the frequency of battery replacements, translating into substantial cost savings and enhanced operational efficiency for solar farm operators.

The allure of LFP batteries extends far beyond their cycle life. They represent a significant stride towards environmental stewardship, boasting a 30% lower carbon footprint compared to many conventional battery chemistries. In an age where sustainability is not just a preference but an imperative, choosing LFP batteries is tantamount to trading in a gas-guzzling vehicle for a sleek, electric alternative—offering identical functionality with a fraction of the environmental impact. This reduced carbon output aligns seamlessly with global efforts to combat climate change and transition towards a greener, more sustainable energy future.

Core Analysis 1: Material Lifecycle & Cost Parity

Material Lifecycle Benefits

Lithium iron phosphate (LFP) batteries redefine sustainability in the energy storage realm. Boasting an exceptional 95% recyclability rate, they stand as paragons of the circular economy, significantly outperforming many counterparts. This remarkable figure means that nearly all components—from cathode materials to electrolyte solutions—can be efficiently recovered and repurposed. By minimizing waste streams and reducing the industry’s dependence on virgin raw materials, LFP batteries play a pivotal role in mitigating environmental degradation.

As emphasized by Recycling Today, this high recyclability factor delivers environmental advantages at every stage of the battery’s lifecycle. From initial production to end-of-life management, LFP batteries embody a “green retirement plan,” ensuring that resources are continuously cycled rather than discarded. This not only conserves natural resources but also reduces the ecological footprint associated with traditional battery disposal methods.

Cost Parity with NMC Batteries

The year 2025 ushers in a transformative milestone for the battery industry: LFP batteries are projected to reach a cost point of €98/kWh, aligning with the pricing of nickel-manganese-cobalt (NMC) batteries. This convergence represents a significant achievement for LFP technology, which has historically been viewed as the underdog in the market.

According to BloombergNEF, several key factors have driven this cost parity. Scaled production volumes have enabled manufacturers to leverage economies of scale, while continuous advancements in manufacturing processes have improved efficiency. Additionally, the relative abundance and accessibility of raw materials required for LFP battery production—such as iron and phosphate—have contributed to cost reductions.

For solar farm operators, this development presents a compelling value proposition. LFP batteries now offer top-tier performance and reliability without the premium price tag traditionally associated with advanced energy storage solutions. This not only eases budgetary constraints but also enhances overall operational efficiency, making LFP batteries an increasingly attractive option for large-scale renewable energy projects.

| Battery Type | 2025 Cost (€/kWh) | Recyclability Rate | Key Advantages |

|---|---|---|---|

| LFP | €98 | 95% | High recyclability, lower environmental impact, stable performance, cost competitiveness |

| NMC | €98–105 | 50–70% | Higher energy density, but with lower recyclability and higher raw material costs |

Core Analysis 2: Grid Services Revenue Streams

Arbitrage Revenue

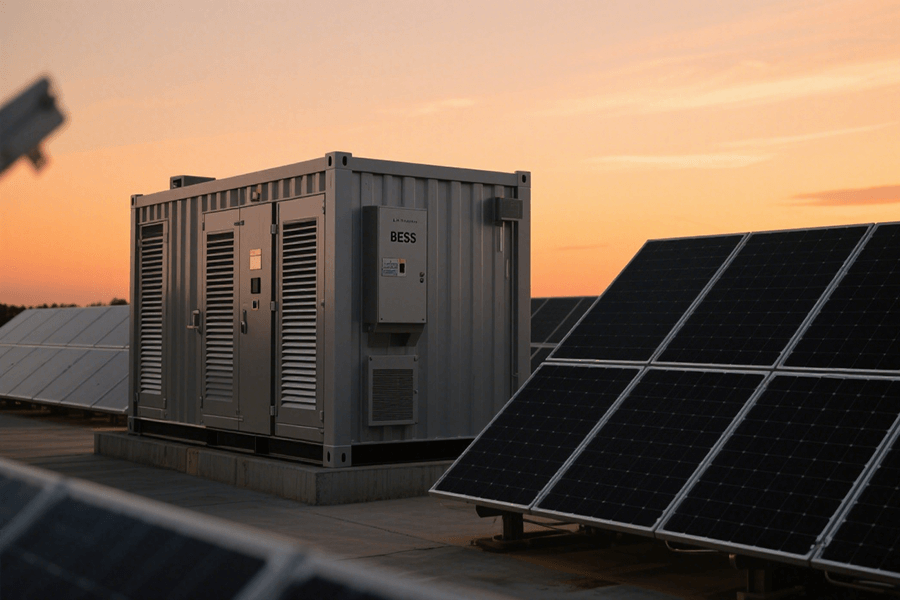

LFP Battery BESS Containers play a pivotal role in enhancing the financial viability of solar farms by capitalizing on electricity price volatility. This revenue generation mechanism operates on a straightforward yet highly effective principle: buying electricity at low prices and selling it at higher prices.

During off-peak hours—typically overnight or during periods of low industrial activity—electricity demand wanes, leading to a corresponding drop in prices. Solar farms, which often produce excess power during these times, can utilize LFP Battery BESS Containers to store this surplus energy. The stored power is then released back into the grid during peak demand periods, such as weekday afternoons and evenings when electricity consumption spikes due to increased residential and commercial usage.

This strategic energy trading model can yield significant financial returns:

- Operators can expect to realize a profit margin of €150/MWh by capitalizing on the price differential between off-peak and peak hours.

- To put this into perspective, a solar farm with a 1 MWh LFP Battery BESS Container system could generate an additional €150,000 in annual revenue, assuming one full cycle of charge and discharge per day.

The operation of LFP Battery BESS Containers in this manner is analogous to the financial concept of “buy low, sell high”. However, instead of trading stocks or commodities, the focus is on trading electricity. By taking advantage of market inefficiencies and price fluctuations, these containers provide a valuable revenue stream that can significantly enhance the return on investment for solar farm operators.

Primary Control Reserves Revenue

Maintaining grid stability is a critical aspect of modern power systems, and LFP-based energy storage systems are well-positioned to play a key role in this endeavor. These systems are engineered with:

- Advanced control algorithms

- High-speed communication capabilities

These features enable them to detect and respond to grid frequency fluctuations within milliseconds.

When the grid frequency deviates from its nominal value—even by a fraction of a hertz—it can have cascading effects on the entire power system, potentially leading to blackouts or other disruptions. LFP-based energy storage systems can quickly:

- Inject power to increase frequency

- Absorb power to decrease frequency

This helps to counteract these frequency deviations and restore grid stability in real-time.

For providing this essential service as primary control reserves, operators are compensated with €80/MWh. This revenue stream:

- Incentivizes the deployment of energy storage systems

- Helps to ensure the reliability and resilience of the grid

By standing ready 24/7 to respond to grid disturbances, these systems act as a reliable buffer between power generation and consumption, helping to balance supply and demand and prevent power outages.

In addition to the financial benefits, providing primary control reserves also offers environmental advantages. By reducing the need for fossil fuel-based peaker plants to operate during periods of high demand or grid instability, LFP-based energy storage systems can help to:

- Lower greenhouse gas emissions

- Promote the integration of renewable energy sources into the grid

Conclusion: Compliance & ROI

Regulatory Compliance

In the energy storage sector, safety and reliability are non-negotiable. LFP Battery BESS Containers have achieved the IEC 62933-5-2 certification, widely recognized as the industry’s gold standard. This certification rigorously evaluates aspects such as electrical safety, thermal management, and mechanical integrity, ensuring that each container:

- Meets global safety norms for installation in diverse environments

- Ensures long-term durability through stringent testing protocols

- Minimizes operational risks associated with energy storage systems

This isn’t merely a compliance mark—it represents a commitment to quality craftsmanship, with no compromises in system design or manufacturing processes.

ROI Projections

The financial viability of LFP Battery BESS Containers is bolstered by dual revenue streams—peak shaving and frequency regulation—and low operational costs. Key financial highlights include:

| Metric | Value | Significance |

|---|---|---|

| Payback Period | 3.8 years | Faster than the average 5-7 year payback for renewable energy assets |

| Annual Savings | 25% | Reduction in energy costs through optimized power usage |

| Revenue Uplift | 18% | Additional income from grid services participation |

These numbers translate to a rapid transition from investment to profitability, making LFP Battery BESS Containers a strategic choice for solar farm operators seeking immediate and sustained returns.

Maxbo Solar: Your LFP Partner

At Maxbo Solar (www.maxbo-solar.com), we transcend traditional product sales by offering end-to-end engineering solutions. Our team of experts follows a customization framework:

- Needs Assessment: Analyzing solar farm capacity, energy demands, and local grid requirements

- System Design: Tailoring BESS configurations for optimal performance and regulatory compliance

- Ongoing Support: Providing maintenance services and performance monitoring to ensure long-term reliability

By choosing Maxbo Solar, you’re not just acquiring a battery system—you’re investing in a grid-stabilizing, profit-generating, and environmentally friendly asset. Let’s collaborate to future-proof your solar farm and drive sustainable energy solutions forward.