Investing in a commercial solar power system is a strategic move for businesses aiming to reduce energy costs and improve sustainability. Understanding commercial solar power system financing options is crucial for making this investment feasible and cost-effective. This comprehensive guide will explore various commercial solar power system financing options available, helping you make informed decisions that align with your business goals.

Overview of Commercial Solar Power System Financing Options

Exploring commercial solar power system financing options involves evaluating several methods to finance your solar investment. Each option has unique advantages and considerations, and selecting the right one depends on your business’s financial situation and goals. commercial solar power system financing options

1. Direct Purchase

1.1 Understanding Direct Purchase

One of the most straightforward commercial solar power system financing options is a direct purchase. This involves paying for the solar power system outright with your capital. This option provides full ownership and allows you to benefit from all incentives and savings associated with the system.

1.2 Benefits of Direct Purchase

- Full Ownership: Direct purchase ensures you own the system entirely, which allows you to capitalize on tax credits and other incentives.

- No Monthly Payments: With no ongoing payments, this option can significantly improve your long-term cash flow.

- Increased Property Value: Owning a solar system can enhance your property’s value, potentially offering a return on investment if you sell.

Reference: U.S. Department of Energy – Solar Financing

1.3 Considerations

- High Initial Cost: The upfront investment is substantial, which might not be feasible for every business.

- Maintenance Responsibility: As the system owner, you are responsible for its maintenance and repair, which could involve additional costs.

2. Solar Leases

2.1 What is a Solar Lease?

A solar lease is another common commercial solar power system financing option. Under this arrangement, you lease the solar power system from a provider for a fixed monthly rate. The provider retains ownership and is responsible for maintenance.

2.2 Advantages of Solar Leases

- Minimal Upfront Cost: Solar leases typically require little to no upfront investment, making it easier to adopt solar technology.

- Maintenance Included: The leasing company handles all maintenance and repairs, reducing your responsibilities.

- Predictable Costs: Monthly lease payments are fixed, which simplifies budgeting.

Reference: Solar Energy Industries Association – Solar Leasing

2.3 Considerations

- Limited Incentives: You might not be eligible for certain tax credits or rebates since you do not own the system.

- Long-Term Contract: Leasing agreements are often long-term, which may limit your flexibility.

3. Power Purchase Agreements (PPAs)

3.1 Understanding PPAs

A Power Purchase Agreement (PPA) is a flexible commercial solar power system financing option where you purchase the electricity generated by the solar system at a predetermined rate. The provider owns and maintains the system.

3.2 Benefits of PPAs

- No Upfront Cost: You avoid initial costs as the provider covers the system installation.

- Reduced Energy Costs: PPAs often offer lower electricity rates compared to traditional utility prices.

- Included Maintenance: The provider is responsible for system maintenance.

Reference: National Renewable Energy Laboratory – Power Purchase Agreements

3.3 Considerations

- Long-Term Commitment: PPAs are typically long-term agreements, which could impact your business’s flexibility.

- Potential Rate Increases: The electricity rate may increase over time, depending on the PPA terms.

4. Solar Loans

4.1 What is a Solar Loan?

A solar loan is a viable commercial solar power system financing option that allows you to finance the purchase of a solar system through a traditional or specialized loan. This method gives you ownership of the system while managing monthly loan payments.

4.2 Advantages of Solar Loans

- Ownership: You own the system, allowing you to benefit from tax incentives and energy savings.

- Flexible Terms: Solar loans offer flexible repayment terms and competitive interest rates.

- Immediate Savings: Well-structured loans can lead to immediate savings on energy costs compared to loan payments.

Reference: Energy.gov – Solar Loans

4.3 Considerations

- Monthly Payments: Managing monthly payments can impact your cash flow.

- Credit Requirements: Approval often requires a strong credit history.

5. Government Incentives and Grants

5.1 Government Incentives Overview

Exploring government incentives and grants is an essential part of understanding commercial solar power system financing options. These programs can significantly reduce the upfront cost of installing a solar power system. commercial solar power system financing options

5.2 Types of Incentives

- Investment Tax Credit (ITC): Allows you to deduct a percentage of the solar system cost from your federal taxes.

- Grants and Rebates: Some governments offer direct financial support to offset installation costs.

Reference: Database of State Incentives for Renewables & Efficiency

5.3 Considerations

- Eligibility: Incentives and grants may have specific eligibility criteria.

- Application Process: Securing these benefits often requires extensive documentation and adherence to program rules.

6. Hybrid Financing Options

Overview

Hybrid financing options combine elements from multiple financing methods to create a tailored approach that meets specific business needs. For instance, you might use a combination of a solar loan and a Power Purchase Agreement (PPA) to balance upfront costs and monthly payments. commercial solar power system financing options

Advantages

- Customized Solutions: Hybrid options allow for a more customized approach, blending different financing models to suit your financial situation and goals.

- Flexible Terms: You can adjust terms to optimize your cash flow and maximize financial benefits.

Considerations

- Complexity: Hybrid financing can be more complex to manage compared to a single financing option, requiring careful coordination between different financial instruments.

Reference: Clean Energy Finance Corporation – Hybrid Financing Solutions

7. Case Studies of Successful Financing

Overview

Examining case studies of businesses that have successfully utilized various commercial solar power system financing options can provide valuable insights and real-world examples. commercial solar power system financing options

Examples

- Company A: Opted for a Power Purchase Agreement and saw a significant reduction in energy costs with no initial investment.

- Company B: Used a combination of solar loans and government incentives to fund a large-scale solar installation, resulting in substantial long-term savings and increased energy independence.

Reference: Solar Energy Industries Association – Case Studies

8. How to Evaluate Financing Offers

Overview

When considering different commercial solar power system financing options, it’s crucial to evaluate the offers carefully to determine which best aligns with your business objectives.

Key Factors

- Interest Rates and Terms: Compare interest rates and terms across different financing options to find the most cost-effective solution.

- Incentives and Benefits: Assess how different financing options impact your ability to claim incentives and benefits.

- Long-Term Financial Impact: Consider the total cost of ownership and the impact on your company’s long-term financial health.

Reference: Finance and Energy – Evaluating Solar Financing

9. Emerging Trends in Solar Financing

Overview

Stay informed about emerging trends in solar financing that could influence future decisions and opportunities for your business.

Trends

- Innovative Financial Products: New financial products and models are emerging to make solar adoption more accessible and affordable.

- Increased Focus on Sustainability: Growing emphasis on corporate sustainability goals is driving innovative financing solutions.

Reference: Renewable Energy World – Solar Financing Trends

Additional Recommendations for Businesses

- Conduct a Thorough Financial Analysis: Before finalizing any financing option, conduct a comprehensive financial analysis to ensure it aligns with your company’s budget and goals.

- Seek Professional Advice: Consulting with financial advisors or solar energy experts can help you navigate the complexities of solar financing and make the best choice for your business.

Why Choose Maxbo for Your Solar Financing Needs

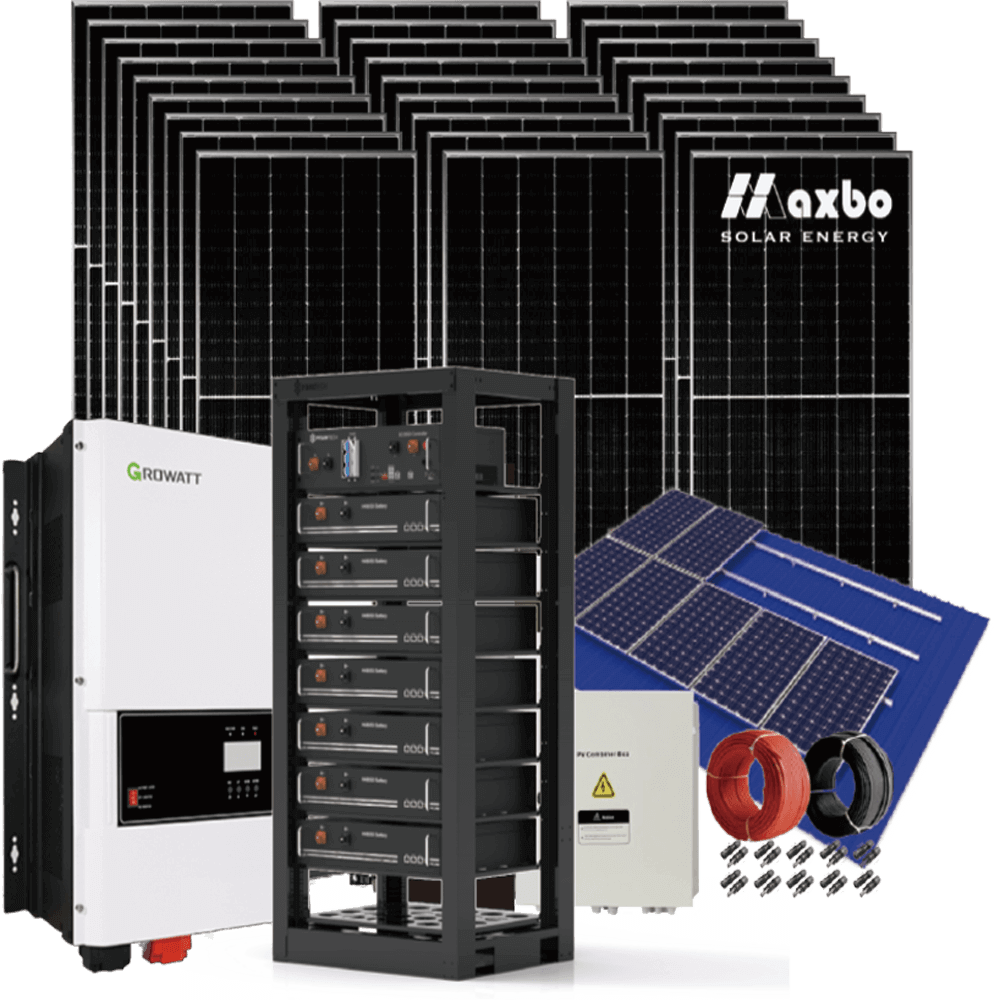

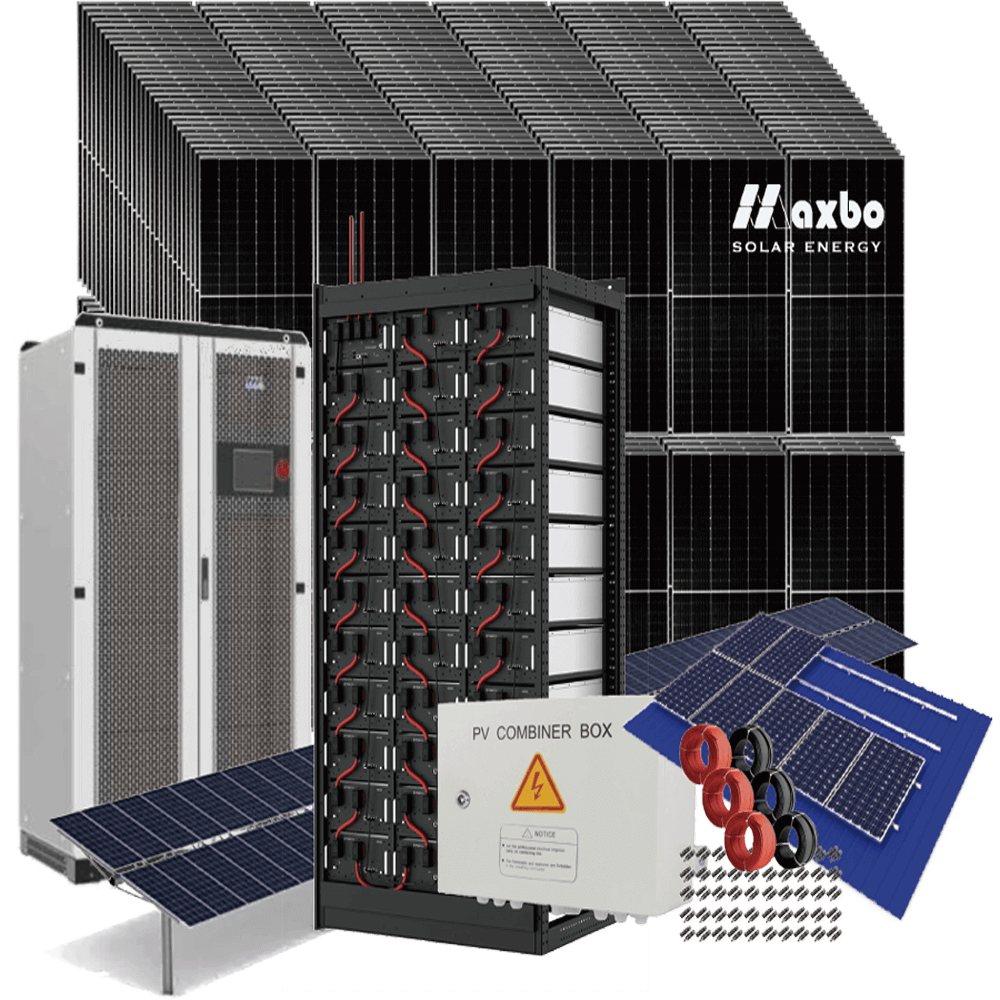

At Maxbo, we offer expert guidance and solutions for navigating commercial solar power system financing options. Our comprehensive approach includes:

- Tailored Financing Solutions: We work with you to identify the best financing options for your specific needs.

- End-to-End Support: From system design to installation and maintenance, we provide full support.

- High-Quality Products: We offer top-tier solar panels, inverters, and energy storage systems to maximize your investment.

For more information on financing options and to explore our solar solutions, visit Maxbo Solar.

Related Solutions

Related Blogs

Grid-Forming BESS Container Europe: Crushing NC RfG 2.0 & Keeping Europe’s Lights (and Espresso Machines) On

行政2025-12-19T14:07:50+08:00December 18th, 2025|Categories: Design, News|

Electric Vessel Charging BESS Container Europe: The Grid-Saving Hero Powering Zero-Emission Maritime

行政2025-12-19T14:09:32+08:00December 18th, 2025|Categories: Design, News|

Let’s Make Things Happen

Add notice about your Privacy Policy here.

Let’s Make Things Happen

”The Maxbo team of sales consultants will continue to enrich our own expertise and experience to empower the development of sustainable energy with rigor.“

Maxbo CEO

You will need to provide: 1. the amount of electricity used. 2. the type and power of the load. 3. the electricity consumption habits (daytime/nighttime consumption). 4. the need to store electricity. 5. the need to feed electricity to the mains. 6. drawings or address of the installation site. 7. other special requirements

We can provide you with a quotation, a specification for all products, a circuit connection diagram and a diagram of the installation and placement of the PV panels. Any other requirements and adjustments needed can be discussed with our team.

We can meet the needs of most scenarios, whether your application is for domestic, commercial and industrial use, in remote areas, or for grid-level energy storage, we have experienced colleagues to design and deliver the right solution.

Add notice about your Privacy Policy here.

How much solar power do I need?

Most homes need 5–12kW, depending on your energy use and location.

Off-grid vs. grid-tied — what’s the difference?

Off-grid works without the utility grid; grid-tied lets you sell extra power back.

Do I need permits?

Usually yes — check local rules or ask us for guidance.

How long does a battery last?

Depends on size and load. A 5kWh battery can power a fridge for about 40 hours.

Can I upgrade my system later?

Yes, our systems are modular and easy to expand.

Does Maxbo offer installation?

We ship globally and connect customers with trusted local installers.