Introduction

Europe’s energy transition isn’t just a policy buzzword—it’s a decades-long marathon to ditch fossil fuels and embrace renewables. But here’s the catch: solar panels go silent at night, and wind turbines stall when the breeze dies. This intermittency poses a significant challenge to grid stability, with data from the European Network of Transmission System Operators for Electricity (ENTSO-E) indicating that renewable energy sources experienced variability-induced power fluctuations of up to 30% in some regions during peak weather-dependent production seasons.

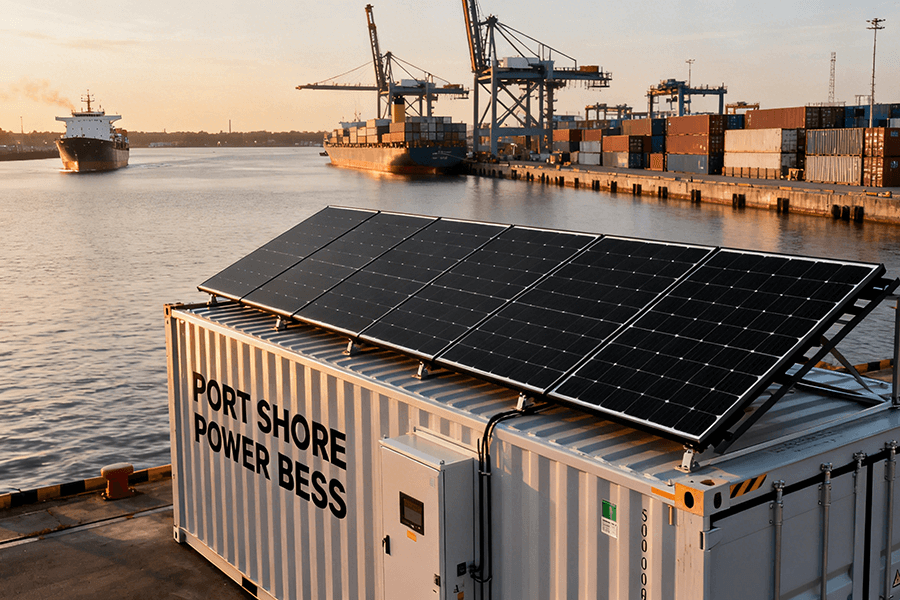

Enter BESS (Battery Energy Storage System) container solutions—the unsung heroes that turn intermittent green energy into reliable power. These compact, scalable systems are modular by design, enabling seamless integration into existing energy infrastructure. A standard 20-foot BESS container, for instance, can store up to 1.5 MWh of electricity, equivalent to powering 300 average European households for an hour. Their scalability allows for configurations ranging from small community projects to large-scale utility installations, as illustrated in the table below:

| Container Size | Typical Capacity Range | Ideal Use Case |

|---|---|---|

| 20-foot | 1-2 MWh | Distributed grid support |

| 40-foot | 3-5 MWh | Large-scale solar or wind farms |

| Customized | 10+ MWh | Utility-scale grid stabilization |

These systems are no longer “nice-to-haves”; they’re the backbone of Europe’s goal to hit a 42% renewable energy share by 2030 (EU Climate Law, 2021). In fact, countries like Germany and the Netherlands are already leading the charge, with Germany’s installed BESS capacity projected to reach 25 GWh by 2025. Think of BESS containers as the “energy backpacks” keeping the continent’s grid charged, stable, and ready for whatever the weather throws its way. Their role extends beyond storage—they optimize energy distribution, reduce reliance on fossil-fueled backup generators, and contribute to the EU’s ambitious target of achieving net-zero emissions by 2050.

Current Market Scale: By the Numbers

As of 2025, the European BESS (Battery Energy Storage System) container market has transitioned from a phase of explosive growth to a more stable and sustainable expansion trajectory. This shift reflects the maturing of the sector as it integrates into existing energy ecosystems. Below, key performance indicators from authoritative industry reports provide a comprehensive overview of the market’s current state and projected development:

| Metric | 2024 Data | 2025 Estimate | Source |

|---|---|---|---|

| Annual BESS Installations (Europe-wide) | 21.9 GWh | 25.2 GWh (15% YoY growth) | SolarPower Europe, 2025-2029 Battery Storage Outlook |

| Total Cumulative BESS Capacity | 61.1 GWh | 86.3 GWh | SolarPower Europe, op. cit. |

| Market Value (Europe BESS Sector) | €11.9 billion ($13.3B) | €13.8 billion ($15.5B) | Mordor Intelligence, Europe BESS Market Report 2025 |

| Top 3 Installing Countries (2024) | 1. Germany (6.2 GWh)2. UK (4.8 GWh)3. Spain (3.5 GWh) | 1. Germany (7.0 GWh)2. UK (5.5 GWh)3. Spain (4.1 GWh) | SolarPower Europe, op. cit. |

These figures underscore Germany’s dominant position in the European BESS landscape, a status fortified by its ambitious energy transition goals.

The nation’s commitment to phasing out coal by 2038, coupled with the highly favorable KfW 431 Program, has been a game-changer. This initiative offers industrial and grid-side BESS projects access to low-interest loans—with rates as low as 1.2%—significantly reducing the financial barriers to entry and spurring investment in large-scale storage solutions.

Moreover, the United Kingdom and Spain have also emerged as key players in the regional market:

- United Kingdom: The UK’s aggressive push towards a net-zero economy, complemented by a series of regulatory incentives and a robust grid modernization strategy, has fueled steady growth in BESS installations.

- Spain: Spain’s abundant solar and wind resources, combined with supportive government policies, have positioned it as a strategic hub for integrating energy storage into its renewable-heavy energy mix.

The upward trend in annual installations and cumulative capacity indicates a growing reliance on BESS containers to address the intermittency challenges associated with renewable energy sources. As countries across Europe strive to achieve their carbon neutrality targets, battery energy storage systems will play an increasingly pivotal role in:

- Stabilizing grids

- Optimizing energy distribution

- Enhancing overall energy security

This sustained growth is also reflected in the sector’s expanding market value, signaling a lucrative opportunity for investors, manufacturers, and service providers alike.

Growth Drivers: Policies & Demand Collide

The BESS container market’s remarkable growth isn’t a coincidence; it’s propelled by two significant driving forces: government policies and unmet grid demand. Let’s delve deeper into each of these factors to understand their impact.

Policy Promotion: Europe’s “Green Incentive Machine”

European nations are not merely discussing energy storage; they are actively investing in it through a range of strategic initiatives. Here’s a detailed look at how some key countries are encouraging the adoption of BESS containers:

| Country | Policy | Incentive Details | Impact in 2024 |

|---|---|---|---|

| Germany | Renewable Energy Act (EEG 2024) | Mandates that all new wind and solar farms with a capacity of ≥50 MW must be paired with BESS systems, with a minimum requirement of 10% of the generation capacity. Additionally, offers KfW loans for BESS projects. | Drove the installation of 3.1 GWh of BESS systems |

| Italy | Conto Energia 7 | Provides feed-in tariffs (FITs) of €0.04/kWh for BESS systems integrated with solar installations. For commercial users, covers 30% of the upfront costs for containerized storage. | Stimulated significant growth in BESS adoption among commercial and residential sectors |

| EU | Green Deal Industrial Plan (2024) | Allocates €2.1 billion specifically for BESS manufacturing and deployment across the EU. Focuses on reducing dependence on non-EU battery imports and promoting domestic production. | Expected to boost the EU’s BESS manufacturing capabilities and accelerate market growth |

These policies not only provide financial incentives but also create a regulatory environment that supports the growth of the BESS container market. By setting clear requirements and offering financial support, governments are encouraging the development of sustainable energy storage solutions.

Demand Growth: Grids & Businesses Can’t Live Without BESS

Grid Stability: Taming Renewable “Whiplash”

While wind and solar energy sources offer significant environmental benefits, their intermittent nature poses challenges for grid stability. The variability in renewable energy output can cause fluctuations in grid frequency and voltage, potentially leading to power outages and system failures. For instance, Scotland’s wind farms, which account for 50% of the UK’s wind power generation, can experience drastic changes in output, dropping from 12 GW to 2 GW within just 6 hours.

BESS containers play a crucial role in addressing these challenges. They act as a buffer, storing excess energy generated during peak production periods and releasing it when renewable energy sources are unable to meet demand. An excellent example of this is the Dogger Bank Wind Farm off the coast of Yorkshire, which is currently the world’s largest offshore wind farm. Equipped with 2 GWh of Tesla Megapacks, the wind farm can store surplus wind energy and discharge it during low-wind periods, ensuring that the grid frequency remains stable at 50 Hz, the standard frequency across the EU. This not only improves the reliability of the power supply but also enables a higher penetration of renewable energy sources into the grid.

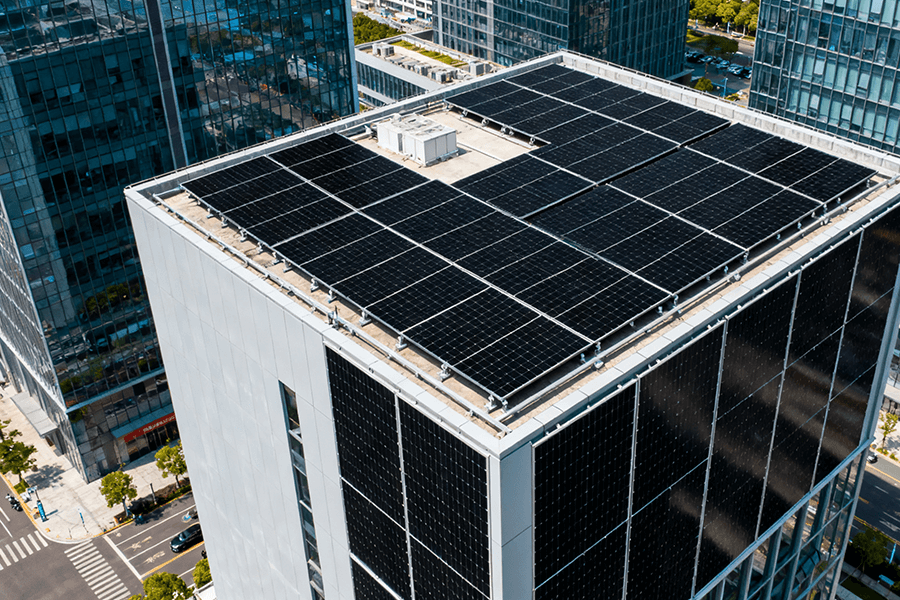

Distributed Energy: Communities Taking Power Into Their Own Hands

In regions with high levels of distributed energy generation, such as the Netherlands, where one in every five homes is equipped with rooftop solar panels, BESS containers are transforming into “community energy hubs.” These hubs allow communities to manage and optimize their energy consumption more effectively.

Take the Groningen Community Storage Project as an example. In this initiative, 500 households share a 5 MWh containerized energy storage system. During the day, when solar energy production is high and electricity prices are relatively low (€0.15/kWh), the BESS charges from the rooftop solar panels. At night, when solar production drops and electricity prices surge to €0.35/kWh, the stored energy is released back into the community grid. This intelligent energy management strategy has resulted in a remarkable 28% reduction in the community’s overall electricity bills.

Moreover, community-based BESS projects like the Groningen initiative promote energy independence and resilience. By reducing reliance on centralized power grids, these projects enhance the local community’s ability to withstand power outages and fluctuations in the energy market. They also contribute to the broader goal of achieving a more decentralized and sustainable energy system in Europe.

Application Expansion: BESS Isn’t Just for Grids Anymore

Gone are the days when BESS containers only sat in remote grid yards. Today, they’re popping up in factories, hospitals, and even EV charging stations, playing pivotal roles across various sectors. Here’s where they’re making the biggest impact:

Grid-Side: The “Grid’s First Responder”

On the grid side, BESS containers act as a crucial safeguard, ensuring the stability and reliability of power distribution.

- Frequency Regulation: Maintaining grid frequency is vital for the smooth operation of power systems. In France, RTE (the national grid operator) has harnessed the power of 1.2 GWh of BESS containers to address frequency deviations in under 1 second. To put this into perspective, a mere 0.5 Hz drop in frequency can trigger the shutdown of nuclear reactors, potentially leading to widespread power outages. BESS containers step in as a “shock absorber,” quickly injecting or absorbing power to keep the grid frequency within the acceptable range.

- Congestion Relief: Aging infrastructure often poses challenges to power transmission. In London, for instance, parts of the grid are outdated, with 30% of its transmission lines operating at 90% capacity. To alleviate this congestion, UK Power Networks deployed 800 MWh of containerized BESS in East London. During peak hours, typically between 7–9 AM, these systems have proven to be highly effective, reducing congestion by 40% and averting potential blackouts. This not only improves the reliability of the grid but also extends the lifespan of existing transmission infrastructure.

Industrial & Commercial: Saving Money, Avoiding Disasters

In the industrial and commercial sectors, BESS containers offer both economic benefits and enhanced resilience.

- Peak-Valley Arbitrage: In Spain, significant differences in peak and off-peak electricity prices create opportunities for cost savings. With peak electricity prices soaring to €0.45/kWh, three times higher than off-peak prices of €0.15/kWh, factories like Coca-Cola European Partners have embraced 2 MWh BESS containers. By charging the batteries during off-peak hours and discharging them during peak hours, these companies can cut their energy costs by a substantial €300,000 per year. This strategy not only reduces operational expenses but also provides a predictable energy cost structure.

- Backup Power: For critical facilities such as hospitals, uninterrupted power supply is non-negotiable. In Italy, hospitals like Ospedale San Raffaele in Milan rely on 500 kWh BESS containers to power essential equipment in the Intensive Care Units (ICUs) during power outages. During Italy’s 2023 heatwave, which led to over 1,200 grid failures, these BESS systems played a heroic role, keeping 12 hospitals operational and ensuring the continuity of patient care.

Renewable Pairings: Wind & Solar’s “Sidekick”

As the world transitions towards renewable energy sources, BESS containers are instrumental in optimizing the integration of wind and solar power. Nordic countries are at the forefront of this trend, showcasing innovative applications of BESS technology.

- Denmark: Horns Rev 3 Wind Farm, with a capacity of 407 MW, has paired with a massive 1.6 GWh BESS container system. When wind speeds exceed 25 m/s, which is too fast for turbines to operate safely, the BESS steps in to store the surplus power. This not only prevents green energy from going to waste but also ensures a more stable and predictable power supply to the grid.

- Greece: Kozani Solar Park, boasting a capacity of 200 MW, utilizes 500 MWh of BESS containers to store the solar energy generated during the day. This stored energy is then discharged at night to supply power to Athens, significantly reducing Greece’s reliance on natural gas peaker plants. In 2024, this innovative approach led to an 18% reduction in the country’s dependence on fossil fuels for meeting nighttime electricity demand.

Competitive Landscape: Global Giants vs. Local Heroes

The European BESS market is a dynamic ecosystem, blending the influence of international powerhouses with the innovation of homegrown enterprises. This competitive landscape is characterized by strategic positioning, technological prowess, and market adaptability. Here’s a detailed look at the key players and their market dominance:

Competitive Landscape Analysis

| Player Type | Key Companies | Market Share (2025 Est.) | Core Technological Edge |

|---|---|---|---|

| Global Brands | Tesla (US)LG Energy Solution (South Korea)CATL (China) | 42% combined | – Tesla: Megapack’s modular design enables seamless scalability up to 3.9 MWh per unit, ideal for large-scale projects.- LG: High-energy-density batteries (280 Wh/kg) enhance storage efficiency.- CATL: Cost-effective lithium-iron-phosphate (LFP) cells offer a competitive pricing advantage. |

| European Brands | Fluence (Germany/US, JV: Siemens + AES)Sonnen (Germany)RedT Energy (UK) | 38% combined | – Fluence: Gridstack’s advanced software suite, including Optimal Storage Control, enables real-time grid response within 200 milliseconds.- Sonnen: The SonnenBatterie 10 features an intuitive user app, making it the preferred choice for 150,000+ German households.- RedT: Flow battery technology provides extended lifespan (20+ years), reducing long-term maintenance costs. |

Case Studies of Market Leaders

Fluence stands out as a technological frontrunner in grid-scale applications. Its Gridstack container system has become the backbone of France’s frequency regulation infrastructure, powering 70% of the country’s key grid stabilization projects. Leveraging ultra-fast response capabilities, Fluence’s solution ensures grid reliability by quickly balancing supply and demand fluctuations.

In the residential segment, Sonnen has achieved remarkable success with its SonnenBatterie 10. Tailored to meet the energy needs of German households, this system offers seamless integration with home energy management systems. Its user-friendly mobile application allows homeowners to monitor, control, and optimize their energy consumption, contributing to its status as the best-selling residential BESS in Germany.

Meanwhile, RedT Energy differentiates itself through its flow battery technology. This innovative approach provides enhanced durability and significantly reduces degradation over time, making it a preferred option for long-term energy storage solutions. The 20+ year lifespan of RedT’s batteries positions them as a sustainable choice for both commercial and industrial applications.

Challenges & Opportunities: The Road Ahead

No market is without its complexities, and the BESS container sector in Europe is no exception. While it confronts significant headwinds, these challenges also herald substantial opportunities for growth and innovation.

Challenges: Navigating the Green Transition Hurdles

Cost Pressures: A Barrier to Widespread Adoption

Lithium-ion battery packs, a cornerstone of most BESS containers, continue to present a financial challenge. According to BloombergNEF’s 2025 Battery Price Survey, the cost of these packs hovers between (130–)150/kWh. For small and medium-sized enterprises (SMEs), investing in energy storage becomes a steep proposition; a 500 kWh BESS system can cost upwards of $75,000. This high upfront cost not only limits the scalability of renewable energy projects but also delays the transition to a more sustainable energy grid.

Technological Disruptions: The Rise of Alternative Chemistries

The emergence of sodium-ion batteries, with a lower cost range of (80–)100/kWh, poses a threat to the dominance of lithium-ion technology. Industry giants like CATL have announced plans to introduce sodium-ion BESS containers in the European market by 2026. These new systems promise improved affordability and reduced environmental impact, potentially disrupting the established lithium-ion supply chain and forcing existing players to adapt or risk losing market share.

Opportunities: Paving the Way for Growth

Eastern Europe: The Untapped Market Potential

Eastern European countries are rapidly emerging as hotspots for BESS container deployment. Poland, for instance, has set an ambitious target of installing 10 GW of wind and solar energy by 2030. However, with its current BESS capacity standing at just 2.1 GWh, there is a significant gap to fill. The Polish government’s Green Investment Scheme, which allocated €500 million for BESS projects in 2024, is a testament to the region’s commitment to renewable energy. This initiative is projected to create a $1.2 billion market opportunity by 2027, attracting both domestic and international investors. Similarly, Hungary and other neighboring countries are also ramping up their renewable energy infrastructure, offering a wealth of opportunities for BESS container providers.

V2G Integration: Redefining Energy Storage

Vehicle-to-grid (V2G) technology represents a revolutionary approach to energy management, and the Netherlands is at the forefront of its implementation. In Rotterdam, a 1 MWh BESS container has been deployed as an energy hub for electric vehicles (EVs). During the day, it charges up to 500 EVs, and at night, it feeds excess power back into the grid, generating a monthly revenue of $12,000 for the operator. This innovative model not only optimizes the use of BESS containers but also contributes to grid stability and reduces peak load demands. As the number of EVs on European roads continues to grow, the potential for V2G integration will only increase, creating new revenue streams and enhancing the overall efficiency of the energy grid.

Conclusion: BESS Containers—Europe’s Energy Future

The BESS container market in Europe is on an upward trajectory, with no signs of slowing down. SolarPower Europe predicts that by 2030, the cumulative capacity of BESS containers will reach 220 GWh, sufficient to power 45 million households for an entire year. This growth is fueled by a combination of supportive policies, increasing demand for grid stability, and ongoing technological advancements aimed at reducing costs.

In this evolving landscape, Maxbo Solar (www.maxbo-solar.com) is well-positioned to lead the charge. As a global provider of BESS container solutions, we offer more than just hardware; we deliver comprehensive energy storage ecosystems designed specifically for the European market. Our range of 20/40/60 MWh container systems are engineered to meet the unique requirements of European customers:

| Feature | Description |

|---|---|

| Compact Design | Designed to fit standard shipping containers for easy transportation and installation |

| Robust Build | Weather-resistant, rated to operate in temperatures ranging from -30°C to 50°C |

| Grid Compatibility | Fully compliant with EU grid standards, ensuring seamless integration |

Our track record speaks for itself. We have successfully delivered projects across Europe, including a 15 MWh system for a solar farm in Spain and a 10 MWh industrial backup system in Germany. Looking ahead, we are excited to expand our footprint in Poland and Hungary in 2026, contributing to the region’s renewable energy goals.

What sets Maxbo Solar apart is our commitment to innovation. By combining high-quality lithium-ion batteries sourced from LG Energy Solution with our proprietary Maxbo Smart Control software, we are able to optimize the charging and discharging processes, reducing operational costs by up to 20%. This not only makes our BESS container solutions more affordable but also more reliable, providing European businesses and grid operators with a cost-effective and sustainable energy storage solution.

The future of European energy is containerized, connected, and clean. At Maxbo Solar, we are proud to be a part of this transformative journey, shaping the energy landscape of tomorrow, today.