Introduction

The Backbone of Grid Stability: European Capacity Markets

Ensuring a continuous and reliable power supply across Europe is a multifaceted challenge that extends far beyond mere electricity generation. At its core lies the imperative of maintaining adequate capacity—the ability to meet fluctuating demand, whether it’s the peak consumption during frigid winter evenings or the high usage on sweltering summer afternoons.

This is where European capacity markets play a pivotal role. These markets are sophisticated regulatory frameworks designed to safeguard long-term grid reliability by procuring power resources 3–5 years in advance. Functioning as a form of “grid insurance,” they compensate operators not just for selling electricity, but for remaining poised and ready to supply power precisely when it’s needed most.

As Europe accelerates its transition away from fossil fuel-based energy sources, the significance of capacity markets has grown exponentially. For example:

- Germany’s ambitious plan to phase out coal power by 2038

- France’s ongoing modernization of its nuclear fleet

These represent major shifts in the continent’s energy landscape. These traditional power generation sources, once the stalwarts of grid stability, are gradually retiring, creating a substantial gap in available capacity.

Virtual Power Plants (VPPs) emerge as a transformative solution to bridge this divide. By aggregating distributed energy resources (DERs) such as:

- Rooftop solar panels

- Small-scale wind turbines

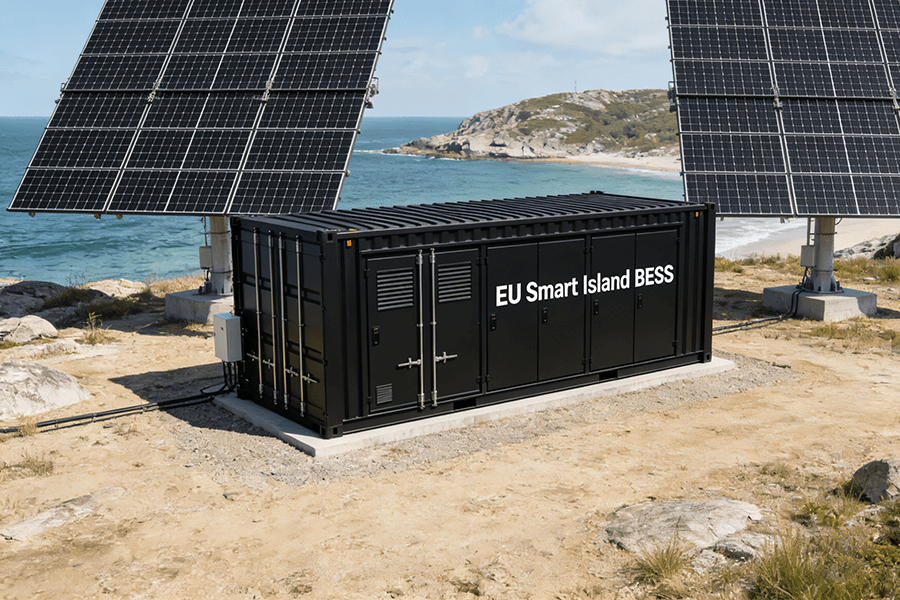

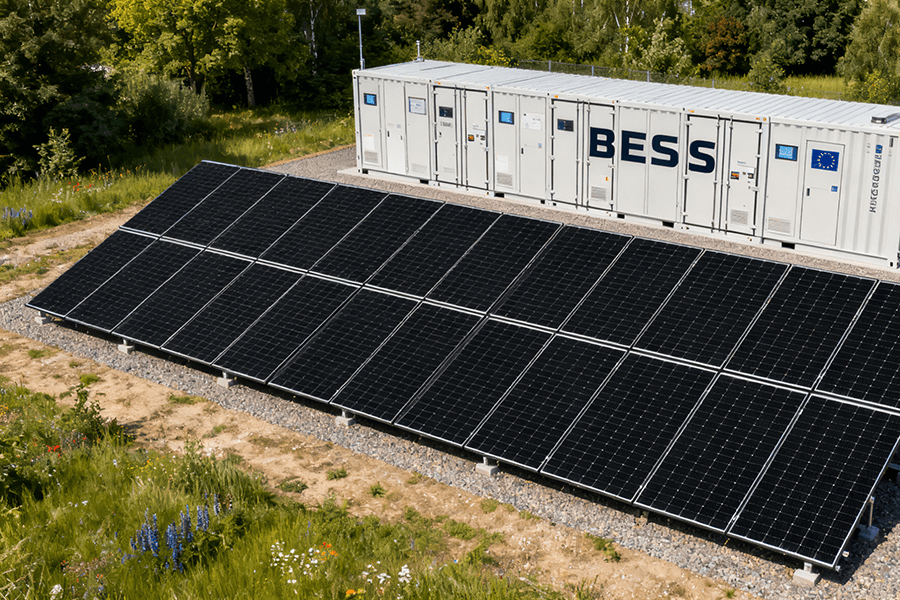

- Battery Energy Storage System (BESS) containers

VPPs consolidate these disparate assets into a unified, grid-responsive entity. This aggregation enables a coordinated approach to power generation and distribution, effectively turning scattered energy sources into a powerful, synchronized force for grid stability.

1.2 BESS Containers: The “Swiss Army Knife” of VPP Capacity Portfolios

In the dynamic ecosystem of VPPs, BESS containers emerge as the linchpin, offering unparalleled value and versatility. Unlike intermittent renewable sources like solar and wind, which are at the mercy of weather conditions, BESS containers provide instantaneous flexibility.

During periods of low electricity demand, typically characterized by excess renewable generation, these containers can rapidly charge, absorbing surplus energy and storing it for future use. Conversely, when demand surges unexpectedly or renewable output suddenly drops—such as during a sudden lull in wind speeds—BESS containers can discharge stored energy within seconds, ensuring seamless grid operation.

To illustrate the critical role of BESS containers, consider a scenario where wind turbines grind to a halt on a calm day. Thanks to their lightning-fast response time, often within 15 minutes or less, and extended discharge duration of 4 hours or more, BESS containers can step in and maintain grid stability before grid operators even have time to react. This exceptional performance makes them indispensable assets for VPPs vying for success in capacity markets.

As emphasized by the European Commission in its Clean Energy for All Europeans Package, BESS technology is “the linchpin of flexible capacity” for decarbonized energy grids, underscoring its pivotal role in Europe’s sustainable energy future. [Source: European Commission, Clean Energy for All Europeans Package: https://ec.europa.eu/energy/topics/clean-energy/clean-energy-for-all-europeans_en]

Understanding VPP Capacity Market Participation

Capacity Auctions: The “Advance Booking” of Grid Capacity

How Auctions Work (Spoiler: It’s Not Just Guesswork)

European capacity markets operate on a forward auction mechanism, a strategic process where grid operators—such as Germany’s Amprion and the UK’s National Grid ESO—initiate a call for suppliers to bid on contracts. These contracts specify the provision of a defined amount of power capacity, measured in megawatts (MW), over a fixed term typically spanning 3 to 5 years. The primary objective behind this approach is to secure essential resources well in advance, thereby safeguarding against last-minute shortages that could disrupt grid stability and reliability.

For Battery Energy Storage System (BESS)-equipped Virtual Power Plants (VPPs), participating in these auctions requires a meticulous and data-driven strategy, which can be broken down into the following key steps:

- Demand Analysis: Leveraging comprehensive historical data and sophisticated grid forecasts, VPPs conduct in-depth analyses to estimate the market’s future capacity requirements. Seasonal variations play a crucial role in this process; for example, during cold winter months, the demand for electricity typically surges, potentially leading to an increased need for contracts exceeding 50MW. By understanding these patterns, VPPs can anticipate market needs more accurately.

- Cost Calculation: A thorough assessment of all relevant costs is essential for setting a competitive bid price. This includes factoring in BESS maintenance expenses, charging costs (which can vary depending on the time of day and energy market prices), and compliance fees associated with operating in the capacity market. The bid price is usually expressed in euros per megawatt per year (€/MW/year), reflecting the total cost of providing and maintaining the capacity over the contract term.

- Delivery Commitment: Winning a bid is not just a financial victory; it comes with a significant obligation. The VPP must guarantee that it can supply the promised capacity whenever the grid operator calls upon it. Failure to meet this commitment results in penalties, which can be substantial and impact the VPP’s profitability and reputation. This commitment is similar to booking a hotel room far in advance for a conference; the grid operator secures the capacity it needs, and the VPP benefits from a stable income stream by keeping its BESS ready for deployment.

Real-World Win: A German VPP’s €15M Score

A prime example of a successful BESS-based VPP bid can be seen in the case of a German VPP aggregator, which partnered with Enel X to participate in a capacity auction. In 2023, this collaboration resulted in the winning of a 4-year capacity contract valued at €15 million. The VPP bid 50MW of BESS-based capacity, a strategic move that paid off handsomely.

The secret to their success lay in a targeted approach. The aggregator focused on Germany’s “capacity shortfall zones,” regions like Bavaria where the rapid retirement of fossil fuel power plants has created a growing need for alternative capacity sources. By identifying these areas of high demand, the VPP positioned itself as a reliable solution. Additionally, the use of artificial intelligence (AI) was pivotal in optimizing the bid price. AI algorithms analyzed market data, competitor behavior, and operational costs to determine a price that was both competitive and profitable. This enabled the VPP to undercut less flexible competitors, such as gas peaker plants, while still generating a healthy return on investment.

This success story is not an isolated incident. German capacity auctions in 2024 saw a significant increase in the allocation of capacity to BESS-equipped VPPs, with 2.3GW of capacity awarded—a 67% rise compared to 2022. [Source: Bundesnetzagentur (German Federal Network Agency), 2024 Capacity Auction Results: https://www.bundesnetzagentur.de/EN/Areas/Energy/Markets/CapacityMarket/CapacityAuctionResults/2024/capacity-auction-2024-node.html]

Capacity Performance Requirements: No “Slacking” Allowed

Securing a capacity contract is only the first milestone for BESS containers; meeting stringent performance requirements is equally crucial to avoid penalties and ensure the long-term viability of their participation in the market. This aspect can be likened to a sports league, where consistent performance and reliability are essential for success and financial reward.

The Key Rules (Enforced by Regulators)

Regulators enforce several key performance requirements to maintain the integrity and reliability of the grid. These requirements are designed to ensure that BESS-equipped VPPs can respond promptly to grid demands, sustain their output during peak periods, and remain available when needed. The following table summarizes the primary performance criteria:

| Requirement | Details | Why It Matters |

|---|---|---|

| Response Time | Must start discharging within 15 minutes of a grid call | Critical for preventing blackouts during sudden demand spikes, ensuring grid stability. |

| Duration | Maintain full output for 4+ hours | Ensures that the capacity can meet extended high-demand periods, such as evening peak hours. |

| Availability | Be “on standby” 95% of the time (excluding maintenance) | Guarantees the grid can rely on the BESS capacity during critical times, enhancing overall reliability. |

How to Ace Compliance: Advanced BESS Controls

The UK’s Octopus Energy provides an exemplary model for achieving high levels of performance compliance. Their 30MW BESS VPP located in Yorkshire achieved an impressive 99.5% performance compliance in 2024, ensuring full contract payments and avoiding any penalties. This outstanding performance was the result of implementing advanced AI-powered control systems that offer several key advantages:

- Predictive Capabilities: The system can forecast grid calls up to 24 hours in advance. This allows the VPP to charge its BESS during periods of low electricity costs, ensuring that it is fully charged and ready to respond when demand increases.

- Real-Time Adjustments: The control system continuously monitors grid demand and adjusts the BESS discharge rates in real time. This dynamic response ensures that the VPP can precisely match the grid’s needs, optimizing both performance and cost efficiency.

- Automated Maintenance Scheduling: By automating maintenance schedules, the system minimizes the risk of “unplanned downtime.” This proactive approach ensures that the BESS remains in optimal condition, maximizing its availability and reliability.

The consequences of non-compliance are severe. For instance, the UK’s National Grid ESO imposes fines of £1,000/MW for every hour that an operator fails to deliver the promised capacity. Octopus Energy’s near-perfect performance in 2024 not only earned them full contract payments but also saved them approximately £120,000 in potential penalties. [Source: Octopus Energy, 2024 BESS Performance Report: https://www.octopusenergy.group/news/octopus-energy-bess-performance-2024]

Revenue Models and Profitability

Long-Term Capacity Contracts: The “Steady Paycheck”

For Battery Energy Storage System (BESS) operators, capacity contracts serve as the financial bedrock, akin to a salaried position in traditional employment. These agreements offer stable, predictable revenue streams that act as a counterbalance to the inherent volatility of short-term energy markets, such as those driven by energy arbitrage opportunities.

Why It’s a Game-Changer

Short-term revenue avenues, like selling energy on the spot market, are subject to extreme price fluctuations. For instance, in 2023, a severe heatwave in Spain triggered a dramatic spike in electricity demand, causing spot prices to surge from €50/MWh to €300/MWh within a single day. This volatility exposes operators to significant financial risks. In contrast, capacity contracts provide a safeguard by locking in revenue over extended periods, typically ranging from 3 to 5 years. Even during periods of market downturns when spot prices plummet, BESS operators with capacity contracts maintain a consistent income stream.

The impact of capacity markets on BESS profitability is exemplified by Endesa, a leading Spanish Virtual Power Plant (VPP) operator. According to their 2024 Sustainability Report, capacity market revenues constitute 30–40% of the company’s total BESS income. This reliable base income has enabled Endesa to pursue an aggressive growth strategy. Between 2023 and 2024, the company doubled its BESS capacity from 20MW to 40MW, leveraging the financial stability provided by long-term contracts to invest in new storage containers and expand its market presence.

Stacking Revenue Streams: “Double (or Triple) Dipping” for Profit

The true potential of BESS containers lies in their ability to generate income from multiple, complementary sources—a strategy known as revenue stacking. By participating in capacity markets, engaging in energy arbitrage, and providing ancillary services, BESS operators can diversify their revenue streams, much like a musician who earns income from concerts, streaming platforms, and merchandise sales. This multi-faceted approach not only maximizes profitability but also reduces dependence on any single market segment.

Example: A Dutch VPP’s €2.5M Annual Boost

Eneco’s 20MW BESS VPP in Rotterdam serves as a prime example of successful revenue stacking. In 2024, the facility harnessed three distinct revenue streams:

- Capacity Market: Secured a 4-year contract for the full 20MW capacity, generating €1.2 million annually. This long-term agreement provided a stable foundation for the project’s financial viability.

- Energy Arbitrage: Capitalized on the price differential between off-peak and peak hours by purchasing excess wind energy at night when prices are typically lower and selling it during daytime peak demand periods. This strategy contributed an additional €0.8 million per year to the bottom line.

- Frequency Regulation: Offered essential grid support services by helping to maintain the 50Hz frequency, a critical parameter for grid stability. This service generated €0.5 million in annual revenue.

Combined, these revenue streams resulted in an annual income of €2.5 million—three times the amount that could have been earned from the capacity market alone. The following table provides a detailed breakdown of Eneco’s 2024 revenue composition:

| Revenue Stream | Annual Earnings (€) | % of Total |

|---|---|---|

| Capacity Market | 1,200,000 | 48% |

| Energy Arbitrage | 800,000 | 32% |

| Frequency Regulation | 500,000 | 20% |

| Total | 2,500,000 | 100% |

[Source: Eneco, Distributed Energy Resources 2024 Report: https://www.eneco.com/en/news-and-insights/reports/distributed-energy-resources-2024]

Market Trends and Policy Drivers

VPP Capacity Markets Are Booming (200% Growth by 2030)

European energy regulators (CEER) project a staggering 200% growth in VPP capacity market volumes by 2030, escalating from 5GW in 2024 to 15GW in the coming six years. This exponential surge is fueled by two pivotal industry shifts:

1. Fossil fuel phase-out: Amidst Europe’s commitment to carbon neutrality, 12GW of coal and gas plants are scheduled for retirement by 2027. This creates an urgent demand for flexible energy sources that can rapidly adjust to fluctuating grid needs.

2. Renewable energy expansion: Solar and wind power are set to dominate Europe’s electricity mix, accounting for 65% of generation by 2030—up from 42% in 2024. However, the intermittent nature of renewables requires robust energy storage solutions like Battery Energy Storage Systems (BESS) to ensure grid stability.

France stands at the forefront of this transformation. In 2024, the country’s capacity auction allocated 1.1GW to BESS VPPs, a significant leap from the 0.3GW awarded in 2022. This trend underscores the growing recognition of BESS as a critical component in Europe’s energy transition.

[Source: CEER (Council of European Energy Regulators), 2030 Capacity Market Forecast: https://www.ceer.eu/ceer-activities/market-monitoring-and-surveillance/capacity-markets/]

Policy Support: The EU’s “Green Light” for BESS

The 2023 EU Electricity Market Design (EMD) Reform has been a landmark development for BESS integration. This regulatory overhaul introduced three key changes:

| Reform Measure | Previous Regulation | New Provision | Impact |

|---|---|---|---|

| Resource Eligibility | Only power plants qualified | BESS classified as “eligible capacity resource” | Expanded market access for BESS providers |

| Contract Duration | 3-year contracts | Extended to 5-year contracts | Enhanced investment certainty |

| Runtime Requirements | Penalties for non-continuous operation | “Minimum runtime” rules waived | Aligned regulation with BESS operational flexibility |

These reforms have already yielded tangible results. In 2024, the first year of EMD implementation, EU BESS capacity within VPPs surged by 41%. This rapid growth validates the effectiveness of policy interventions in accelerating the deployment of energy storage solutions.

[Source: European Commission, EMD Reform Implementation Report 2024: https://ec.europa.eu/energy/topics/markets-and-consumers/electricity-market-design_en]

Case Study: French VPP’s 100MW BESS Project (€40M Contract)

Project Overview

In 2023, Neoen, a prominent French renewable energy firm, made a significant stride in the energy storage sector by launching a 100MW Battery Energy Storage System (BESS) within a Virtual Power Plant (VPP) framework in southern France, near Marseille. This strategic initiative was not merely a technological endeavor but a calculated business move with clear financial objectives.

The overarching goal of this project was twofold:

- Secure a long – term capacity contract in the highly competitive European energy market.

- Implement a revenue stacking strategy to maximize return on investment (ROI).

This ambitious project aimed to demonstrate the commercial viability of BESS – VPPs in the context of capacity markets, setting a precedent for future developments in the industry.

The Winning Strategy

1. Auction Targeting

Neoen’s approach to the capacity market auctions was data – driven and region – specific. The company meticulously identified France’s “capacity deficit regions”, with a particular focus on the Provence – Alpes – Côte d’Azur area. This region was chosen strategically, as several nuclear plants were undergoing upgrades, creating a significant gap in the power supply that needed to be filled. By targeting this area, Neoen capitalized on the existing demand for additional capacity.

In terms of bidding, Neoen adopted a competitive pricing strategy:

- It submitted a bid of €80/MW/year, which was lower than the typical bids from gas plants, which averaged around €120/MW/year.

- However, this price was carefully calculated to not only undercut competitors but also ensure that all operational and capital costs could be covered, leaving room for a reasonable profit margin.

This bid strategy was a delicate balance between competitiveness and financial sustainability, reflecting Neoen’s deep understanding of the market dynamics.

2. Performance Prep

To ensure optimal performance and reliability, Neoen made substantial investments in cutting – edge technology:

- The company installed Tesla Megapack BESS containers, which are renowned for their high energy density and robust design.

- These Megapacks were integrated with advanced AI – powered control systems.

The AI controls played a crucial role in the operation of the BESS:

- They were designed to predict grid calls with a high degree of accuracy, allowing the system to anticipate changes in power demand and supply.

- By leveraging historical data, real – time market information, and weather forecasts, the AI could make informed decisions about when to charge and discharge the batteries.

- This not only optimized the use of the energy stored in the BESS but also ensured that the system could respond quickly and efficiently to grid requirements, enhancing its overall performance and reliability.

3. Revenue Stacking

Neoen’s revenue strategy was centered around the concept of revenue stacking, which involved diversifying income streams to increase profitability. In addition to the revenue generated from the capacity contract, the company planned to participate in the frequency regulation market.

In France, the RTE grid operator is responsible for maintaining the stability of the electrical grid by ensuring that the frequency remains within a narrow range. To achieve this, RTE pays energy providers, such as Neoen, €50/MW/hour for frequency regulation services.

By combining capacity revenue with the income from frequency regulation, Neoen created a more stable and lucrative revenue model:

- The capacity contract provided a guaranteed base income.

- The frequency regulation service offered an additional source of revenue that could fluctuate based on grid demand.

This dual – revenue approach not only reduced financial risks but also enhanced the overall return on investment.

5.3 Results (2024 Update)

Contract Win

Neoen’s strategic efforts paid off handsomely, as the company successfully secured a 5 – year capacity contract worth €40 million. The calculation is as follows:

(100MW text{ (capacity)} times â¬80/MW/year text{ (bid price)} times 5 text{ years (contract duration)})

This long – term contract not only provided Neoen with a stable revenue stream but also served as a validation of the company’s business model and the viability of BESS VPPs in the capacity market.

Performance

The performance of the 100MW BESS VPP was remarkable:

- It achieved an impressive 98.2% compliance rate, meaning the system met all the grid operator’s requirements without incurring any penalties.

- The system only experienced 1.8% downtime, primarily due to scheduled maintenance activities.

This minimal downtime was a testament to:

- The reliability of the Tesla Megapack BESS containers.

- The effectiveness of the AI – powered control systems.

It also demonstrated Neoen’s commitment to maintaining high – quality operations, ensuring that the BESS VPP could consistently deliver the promised capacity and services to the grid.

ROI

The financial returns of the project were equally impressive, with Neoen reporting an annual return on investment (ROI) of 15%. This significant ROI was largely attributed to the revenue stacking strategy. The breakdown of the revenue sources contributing to this ROI was as follows:

- 60% from capacity revenue.

- 30% from frequency regulation.

- 10% from arbitrage (the practice of buying energy at a low price and selling it at a higher price, taking advantage of price differences in different market segments or time periods).

This diversified revenue structure not only maximized profits but also provided a buffer against market fluctuations, ensuring the long – term financial sustainability of the project.

Buoyed by the success of this initial project, Neoen now has plans to expand the capacity of its BESS VPP to 200MW by 2026. This planned expansion serves as strong evidence that BESS VPPs can be scaled up profitably, opening up new opportunities for growth in the renewable energy and energy storage sectors.

[Source: Neoen, Marseille BESS VPP 2024 Progress Report: https://www.neoen.com/en/projects/marseille-bess-vpp]

Best Practices for Success

Drawing insights from the experiences of Neoen, as well as other industry players such as Octopus and Enel X, several key best practices emerge for success in the BESS VPP capacity market:

1. Optimize bids with data

In today’s highly competitive capacity market, relying on guesswork for bidding is a recipe for failure. Instead, companies should leverage the power of artificial intelligence (AI) and data analytics:

- By using AI to analyze historical data on regional capacity deficits, market trends, and competitor behavior, companies can make more informed and strategic bidding decisions.

- This data – driven approach allows for a deeper understanding of market dynamics, enabling companies to tailor their bids to maximize the chances of winning contracts while maintaining profitability.

2. Invest in high – performance BESS

While it may be tempting to cut costs by opting for cheaper BESS systems, this short – term savings can lead to long – term losses. Low – quality systems are more likely to fail to meet the strict compliance requirements of grid operators, resulting in costly penalties.

Investing in high – performance BESS solutions, such as the Tesla Megapack used by Neoen, ensures:

- Reliability.

- Efficiency.

- Compliance.

These high – end systems may have a higher upfront cost, but they offer better performance, longer lifespans, and lower maintenance costs over time, ultimately leading to higher returns on investment.

3. Partner with aggregators

Partnering with experienced VPP aggregators, like Enel X, can be a game – changer in the capacity market:

- These aggregators have in – depth knowledge and expertise in navigating the complex auction processes and implementing effective revenue stacking strategies.

- They understand the nuances of different markets, regulatory requirements, and grid operator needs.

By collaborating with aggregators, companies can benefit from:

- Their experience.

- Access to resources.

- Established relationships.

This increases their chances of success in the highly competitive capacity market. Although there may be fees associated with these partnerships, the potential for increased revenue and reduced risks far outweigh the costs.

Conclusion

The Opportunity Is Now

European VPP capacity markets are a goldmine for BESS operators. They offer stable long-term revenue (critical for balancing short-term volatility) and a chance to lead Europe’s decarbonization. With 200% growth predicted by 2030 and policy support from the EU, there’s no better time to act.

How Maxbo Solar Empowers Your Success (First-Person)

At Maxbo Solar (www.maxbo-solar.com), we don’t just sell BESS containers—we build “capacity market winners.” Here’s how we support operators:

- High-performance BESS: Our 20-foot and 40-foot containerized BESS systems meet EU performance standards (15-minute response time, 4+ hour duration) and come with AI control software (predicting grid calls and optimizing compliance).

- Auction support: Our team of former grid regulator experts helps you analyze markets and set winning bid prices (we’ve helped clients win contracts in Germany, France, and the UK).

- Turnkey service: We handle everything from installation to maintenance—so you can focus on stacking revenue, not fixing equipment.

In 2024, we helped a Belgian operator win a 30MW capacity contract worth €6.3 million—and they achieved 99% compliance (full payments!). We’re not just a supplier; we’re your partner in profiting from capacity.

Visit www.maxbo-solar.com today to learn how our BESS containers can unlock your VPP’s full revenue potential. The grid needs flexible capacity—and you need to profit from it. Let’s build that future together.