Why 50Hz Is the Grid’s “Non-Negotiable Beat” (And Fossil Fuels Are Dropping the Ball)

Picture the European grid as a high-stakes ballet: every power source (dancer) must move in perfect sync to hit the 50Hz rhythm. A 0.1Hz deviation? That’s the ballet equivalent of a prima ballerina tripping mid-pirouette—chaos follows, from factory shutdowns to widespread blackouts.

This frequency stability challenge is magnified by the grid’s changing cast. The traditional main players—fossil fuel power plants—are taking their final bows.

According to Eurostat data, as of 2024, wind and solar generation account for over 40% of EU electricity, up from 32% in 2020. These new stars, while environmentally friendly, bring a unique set of performance issues:

- Intermittency: Wind farms can experience sudden output drops when weather conditions shift, like a calm replacing a storm.

- Predictability: Solar energy production vanishes at nightfall, creating sharp demand-supply imbalances.

These renewable sources lack the responsiveness of their fossil fuel predecessors. Traditional power plants, once the “frequency police,” could quickly adjust output to correct grid fluctuations. But renewables’ erratic swings strain the grid’s ability to maintain that critical 50Hz tempo.

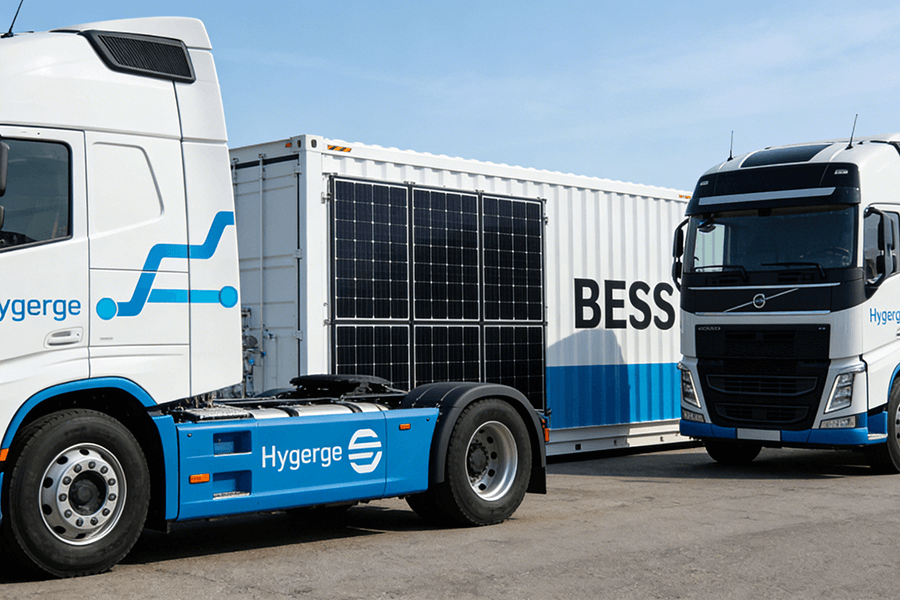

Enter BESS (Battery Energy Storage System) containers: the grid’s new understudy turned headliner. These technological marvels offer several game-changing advantages:

| Feature | Benefit for Grid Frequency Response |

|---|---|

| Compact Size | Can be installed in limited spaces, like parking lots or rooftops |

| Silent Operation | Environmentally friendly with no noise pollution |

| Rapid Response | Faster startup times compared to gas plants, enabling immediate frequency correction |

BESS containers aren’t just resolving frequency issues—they’re also generating significant revenue. By participating in frequency response markets, these systems earn payments for maintaining grid stability, turning a technical necessity into a profitable business opportunity.

Why BESS Containers Are the FFR MVPs (No Contest)

Forget “good enough”—BESS containers dominate FFR markets because they outshine every competitor in two make-or-break categories: speed and flexibility. These attributes aren’t just technical specs; they’re the keys to revolutionizing grid operations and driving the energy transition forward.

Ultra-Fast Response: Milliseconds Win (Fossils Can’t Keep Up)

In the high-stakes world of grid frequency regulation, every millisecond counts. When the grid’s frequency dips, the last thing you want is a power plant that takes 10 seconds to “wake up”—you need a system that reacts faster than the blink of an eye.

BESS containers deliver precisely that, responding in a jaw-dropping 100 milliseconds to 1 second. This blistering speed leaves traditional power sources in the dust, rendering them virtually obsolete for modern frequency response requirements.

To illustrate the stark contrast, consider the following table comparing the response times and grid roles of different power generation technologies:

| Technology | Response Time | Grid Role | Real-World Impact |

|---|---|---|---|

| BESS Containers | 100ms–1s | First responder (PFR hero) | Cuts frequency incidents by 30% |

| Hydropower | 2–3s | Slow backup | Struggles with sudden grid swings |

| Gas-Fired Plants | 5–10s | The one still tying its shoes | Too slow for modern FFR demands |

The data speaks for itself. Germany’s Transmission System Operator (TSO), Tennet, reported a 30% drop in frequency deviation incidents after integrating BESS containers into its FFR services. This significant reduction in grid instability can be directly attributed to the lightning-fast response times of BESS containers. By acting as the grid’s first line of defense and nipping small frequency blips in the bud, BESS containers prevent minor fluctuations from escalating into full-blown crises.

Flexibility & Scalability: From “Tiny Boxes” to Grid Giants

BESS containers are the ultimate utility players in the energy grid ecosystem, earning the moniker of the grid’s Swiss Army knife. Their unparalleled flexibility allows them to ramp up or down their output from 0 to 100% in real time, adapting to the grid’s ever-changing demands with the finesse of a seasoned DJ. Whether it’s compensating for sudden drops in wind power generation or dialing back during periods of excess solar output, BESS containers seamlessly balance supply and demand, ensuring grid stability.

But the advantages of BESS containers don’t stop at flexibility—they also offer remarkable scalability. Thanks to their modular design, these units can be stacked and interconnected like Lego blocks, enabling grid operators to build up capacity incrementally without the need for large-scale construction projects.

Case Study: The Netherlands’ Modular Solution

Take the Netherlands as a prime example. Facing grid congestion as tight as Amsterdam’s bike lanes during rush hour, Dutch developer Giga Storage opted for a smart, modular approach. Instead of building a single massive BESS facility, they aggregated dozens of smaller units, leveraging the scalability of BESS containers to secure a 300MW/1,200MWh contract with Tennet.

This innovative solution not only addressed grid congestion but also unlocked significant cost savings, with a 65% discount on transmission tariffs for limiting grid use to off-peak hours. The result? Instant FFR capacity without the hassle of new power lines or construction delays.

Innovative Development in 2025

S4 Energy took the concept of scalable BESS solutions to the next level in 2025, launching the Netherlands’ first 4-hour duration BESS (10MW/40MWh) in Zeeland. “The grid is strained, and storage is the only way to keep energy affordable,” said CCO Dominique Becker Hoff. This statement encapsulates the dual value proposition of BESS containers: they not only alleviate grid challenges but also present lucrative opportunities for market participants, making them a win-win solution for the energy industry.

The FFR Market Playbook: Where BESS Containers Cash In

FFR isn’t a one-size-fits-all game. BESS containers dominate three key segments, each with its own profit potential.

Primary Frequency Response (PFR): The “Get Paid to React” Gig

PFR serves as the grid’s emergency lifeline, playing a crucial role in maintaining grid stability. It demands an instantaneous response within just 1 second to sudden frequency fluctuations. Transmission System Operators (TSOs) are well aware of its critical importance, which is why they offer significantly higher compensation compared to other Frequency Response (FFR) services. In fact, PFR rates are 2–3 times higher than those of alternative FFR offerings, making it an extremely attractive revenue stream for BESS container operators.

Key Numbers for Operators

| Metric | Details |

|---|---|

| Annual Earnings per 1MW BESS |

A single 1MW BESS container can generate €50,000–€80,000 annually solely from PFR services, clearly highlighting its highly lucrative nature.

|

| Market Share in the UK |

BESS has seen remarkable growth in the UK’s PFR market. It now supplies 60% of National Grid’s PFR capacity, a significant increase from a mere 10% in 2019.

|

| Response Time Advantage | Unlike gas plants, which can take up to 5 seconds to start responding—a delay comparable to waiting for a snail to extinguish a fire—BESS containers provide near-instantaneous support. |

Secondary Response & Fast Reserve: The “Steady Paycheck” Segments

For operators in search of long-term stability and predictable revenue streams, secondary response (with a 30-second latency) and fast reserve (which stands by to address unexpected outages) are appealing options. These services typically come with 2–5 year contracts, offering a shield against market volatility and eliminating the need for constant market speculation.

A prime example of success in this segment comes from Spain’s Acciona Energía. In 2025, the company’s 10MW BESS fleet secured a 4-year fast reserve contract, guaranteeing €1.2 million in annual revenue. As Carlos Ruiz, Acciona’s Energy Storage Director, aptly put it, “It’s like having a rental property for the grid—steady cash flow, no tenant headaches.” This analogy perfectly captures the reliability and low-maintenance nature of these long-term contracts, making them an attractive choice for BESS operators looking for stable income.

2025 Market Trends: Why BESS Profits Are Skyrocketing

If 2024 was BESS’s “breakout year,” 2025 is its “blockbuster sequel.” Two trends are driving profits to new heights:

FFR Prices Are Booming (Thanks to Grid Chaos)

EU FFR (Frequency Frequency Response) prices have experienced a remarkable surge, increasing 25–40% annually since 2023, and 2025 continues this upward trajectory. The root causes of this price explosion can be attributed to two primary factors:

Grid congestion: A growing bottleneck

Countries like the Netherlands and Germany, at the forefront of the renewable energy transition, are grappling with an infrastructure challenge. Their existing power grid infrastructure is unable to keep pace with the rapid growth of renewable energy sources.

The construction of new power lines, a complex and time-consuming process involving regulatory approvals, land acquisition, and engineering hurdles, lags far behind the installation of new wind farms and solar arrays. As a result, grid congestion occurs, where the grid’s capacity to transmit electricity from generation sites to consumers is strained. This congestion forces Transmission System Operators (TSOs) to seek alternative solutions, driving up the demand—and price—for FFR services.

Renewable volatility: The double-edged sword of clean energy

Wind and solar power, while offering a sustainable energy future, come with an inherent challenge: variability.

- Solar power: Its output depends on sunlight availability, which fluctuates throughout the day and is affected by weather conditions.

- Wind power: Generation is subject to wind speed variations, which can change rapidly and unpredictably.

These output swings create instability in the grid, as the supply of electricity needs to match demand in real-time to maintain grid stability. To avoid potential blackouts and ensure a reliable power supply, TSOs are willing to pay a premium for FFR services, which help balance the grid by quickly adjusting power generation or consumption.

According to ENTSO-E (European Network of Transmission System Operators for Electricity), the EU FFR market is projected to reach €2 billion by 2030. This astronomical figure represents a significant opportunity for container-sized batteries, which are well-suited to provide the rapid response required by FFR services.

Hybrid Renewable-BESS Projects: Double the Profit, Half the Headache

Pairing BESS (Battery Energy Storage System) containers with wind or solar farms has emerged as one of the most innovative and lucrative strategies in the energy sector in 2025. This hybrid approach capitalizes on the complementary strengths of renewable energy sources and battery storage, creating a win-win situation for project developers and grid operators alike.

Here’s a detailed breakdown of how it works:

| Scenario | Power Source Activity | Revenue Generation |

|---|---|---|

| When the sun shines or wind blows | The wind or solar farm generates electricity at peak capacity and sells it to the grid at market rates. | Standard revenue from power sales. |

| When output is stable or low | The BESS container steps in, discharging stored energy to provide FFR services to the grid. | Additional revenue from FFR service fees. |

The result? A significant boost in project revenue, with an estimated 15–20% increase on average. This enhanced profitability not only makes renewable energy projects more attractive to investors but also helps accelerate the transition to a clean energy future.

Denmark’s Ørsted, a global leader in offshore wind, is leading the charge in this trend. Their highly anticipated 3GW offshore wind tender, set to launch in autumn 2025, will require BESS integration as a condition for participation. This bold move signals a shift in the industry towards more sustainable and flexible energy solutions.

Early adopters of hybrid renewable-BESS projects have already reaped substantial rewards. For instance, a Danish wind farm equipped with a 5MW BESS system managed to double its profit margin by combining revenue from power sales and FFR earnings. These success stories serve as a testament to the potential of hybrid projects and are likely to inspire more developers to follow suit in the coming years.

Our Playbook: How Maxbo Solar (That’s Us!) Is Winning the FFR Game

At Maxbo Solar (www.maxbo-solar.com), we didn’t just build BESS containers—we engineered them to dominate EU FFR markets. Here’s how we’re helping operators cash in:

Speed That Beats the Competition

Our liquid-cooled Battery Energy Storage System (BESS) containers are a game-changer, boasting an impressive 2C discharge rate. To put that into perspective, a 3MWh unit can deliver a staggering 6MW of power instantly, making it the ideal solution for Primary Frequency Regulation (PFR) services with their stringent 1-second response deadline.

What sets our liquid-cooled design apart from traditional air-cooled systems is its ability to maintain optimal performance under stress. Clunky air-cooled alternatives often suffer from overheating issues, which not only slow down response times but also shorten the lifespan of the equipment. In contrast, our advanced thermal management system eliminates hotspots, ensuring rapid response and an extended lifespan of 15+ years—significantly longer than the industry average of 10–12 years.

| Cooling Type | Response Time | Lifespan | Overheating Risk |

|---|---|---|---|

| Liquid-cooled | Instant (2C discharge) | 15+ years | Low |

| Air-cooled | Delayed | 10–12 years | High |

Grid-Friendly Flexibility (Tailored to TSO Rules)

Navigating the diverse regulatory landscapes of European Transmission System Operators (TSOs) can be a daunting task. Each TSO has its own unique set of Frequency Response (FFR) rules and preferences:

- Tennet: Favors short-term contracts, providing flexibility for operators looking to respond quickly to market fluctuations.

- UK National Grid: Prioritizes Primary Frequency Regulation (PFR) services, demanding rapid and reliable power adjustments.

- Spain’s REE: Prefers long-term fast reserve deals, offering stability and predictability for operators.

At Maxbo Solar, we understand that a “one-size-fits-all” approach simply won’t cut it. That’s why we work closely with our clients to tailor each BESS to the specific requirements of their target TSOs. We don’t just sell equipment—we provide customized solutions that are designed to succeed in the European FFR markets.

Our flexibility extends beyond regulatory compliance. We also offer aggregation services, helping operators combine small BESS units into mega-capacity fleets. For example, we partnered with a Dutch developer to integrate 20x 500kWh BESS containers, creating a powerful 10MW FFR resource. This aggregated fleet secured a lucrative 2-year contract with Tennet, generating an annual revenue of €600,000—all without the need for a costly infrastructure overhaul.

Profits You Can Bank On (Fast ROI, Low Risk)

The financial benefits of our BESS solutions are undeniable. Take our Amsterdam data center project, for instance. Our 3MWh BESS achieved an astonishing 99.999% uptime, effectively eliminating the need for expensive diesel generators. This not only reduced backup costs by a remarkable 60% but also provided a reliable and sustainable power source for the data center.

For FFR operators, our BESS solutions offer a fast return on investment (ROI) and low risk. Our 1MW units typically achieve break-even within 3–4 years, significantly faster than the industry average of 5–6 years. And the success stories keep coming:

- A UK operator using our 5MW BESS earned an impressive €350,000 in PFR revenue in 2024 alone, covering 40% of the system’s cost in just 12 months.

- Another client in Germany saw their FFR earnings increase by 300% after switching to our BESS solution.

These results speak for themselves. At Maxbo Solar, we’re not just building BESS containers—we’re building profitable, sustainable solutions that are designed to thrive in the competitive European FFR markets.

Conclusion: The BESS Container Revolution Is Here (Don’t Miss Out)

Fossil fuels once ran the grid’s frequency show—but now they’re stuck in the wings, too slow and too inflexible for 2025’s grid.

BESS containers are the new stars: faster, more flexible, and far more profitable.

The BESS Boom: A 2025 Golden Opportunity

With EU FFR prices soaring, TSOs begging for capacity, and hybrid projects boosting revenue, 2025 isn’t just a good time to invest in BESS—it’s the last chance to get in early.

Maxbo Solar: Powering the BESS Revolution

At Maxbo Solar, we’re building the containers that power this revolution. Visit www.maxbo-solar.com to see how we can turn your grid stability goals into cold, hard euro.