Why Capacity Markets Need BESS Like Coffee Needs Cream

Let’s face it: Europe’s grid is going through a midlife crisis. Fossil fuel plants are retiring faster than a boomer at 65 (Belgium’s nuclear phase-out wraps in 2025, and Germany’s coal exit is set for 2038), and wind/solar—bless their intermittent hearts—can’t always show up to the reliability party.

This energy transition conundrum has thrust capacity markets into the spotlight as the grid’s “backup plan” auctions. These markets enable operators to secure future power capacity, ensuring uninterrupted electricity supply during peak demand periods, whether it’s a winter cold snap or a summer heatwave.

Key European Capacity Markets to Watch

Not all capacity markets are created equal. Each region has tailored its rules and incentives to address unique energy challenges, with some emerging as particularly favorable for Battery Energy Storage Systems (BESS).

Here’s a comprehensive breakdown of the most BESS-friendly markets:

|

Market Name

|

Country

|

Core Rules

|

BESS Focus Area

|

2024 BESS Contract Volume

|

Growth Trajectory

|

|

UK Capacity Market

|

United Kingdom

|

3–15 year contracts; 4-hour discharge duration preference; capacity payments

|

Long-duration reliability

|

620 MW

|

↑ Strong

|

|

Belgium Capacity Remuneration Mechanism (CRM)

|

Belgium

|

Pay-as-bid pricing; annual (Y-1) and four-year (Y-4) auctions

|

Fast deployment (6–12 months)

|

450 MW

|

↑ Moderate

|

|

Italy Terna Capacity

|

Italy

|

Preference for hybrid (renewable+BESS) bids; grid balancing incentives

|

Intermittency mitigation

|

89 MW

|

↑ High-potential

|

|

Central-West EU Mechanism

|

Cross-border

|

Cross-country capacity trading; harmonized rules across Belgium, France, etc.

|

Regional grid stability

|

320 MW (cross-border)

|

↑ Rapid

|

Data Sources:

- [European Network of Transmission System Operators for Electricity (ENTSO-E)]

- [National Grid ESO (UK)]

- [Belgian Federal Public Service for Energy]

- [Terna Spa (Italy)]

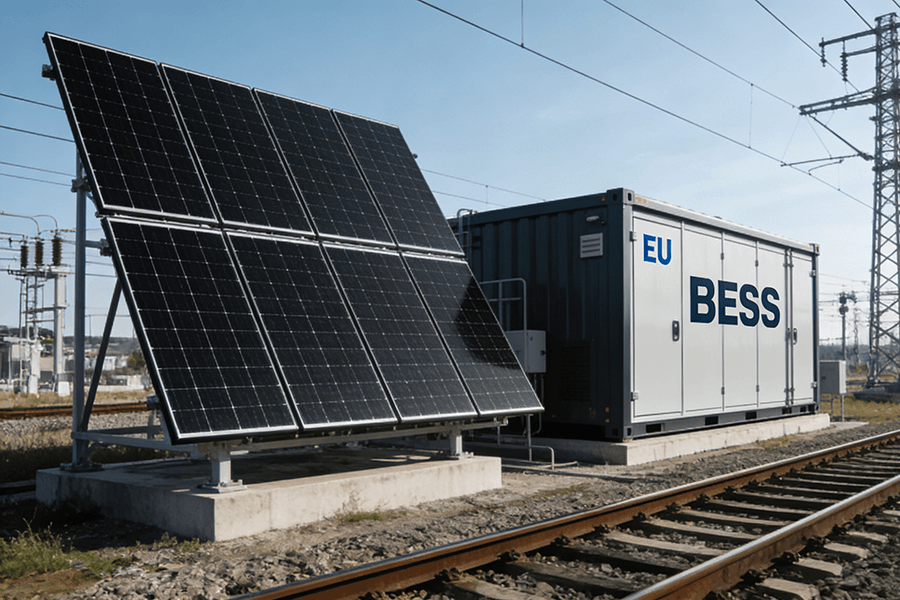

BESS Containers: The Grid’s New MVP

BESS containers aren’t just “another option”—they’re a game-changer. These modular storage units combine cutting-edge battery technology with standardized shipping-container designs, revolutionizing how energy storage integrates into the grid.

Here’s a detailed comparison highlighting their competitive advantages over traditional storage solutions:

|

Feature

|

BESS Containers

|

Traditional Fixed-Site Batteries

|

Gas-Fired Power Plants

|

|

Deployment Timeline

|

6–12 months

|

2–5 years

|

3–7 years

|

|

Cost per MWh Installed

|

€150,000–€300,000

|

€200,000–€400,000

|

€800,000–€1,200,000

|

|

Maintenance Expenses

|

40% lower than fixed-site batteries

|

Standard grid-tied system costs

|

High operational costs

|

|

Scalability

|

Plug-and-play modules; easy expansion

|

Limited by site infrastructure

|

Requires large-scale planning

|

|

Geographic Flexibility

|

Relocatable to meet changing demand

|

Permanently installed

|

Site-dependent

|

These attributes make BESS containers the “fast, cheap, and reliable” solution that auction organizers and grid operators can’t afford to overlook. Their ability to rapidly deploy, adapt to grid needs, and provide cost-effective energy storage positions them as critical assets in Europe’s energy transition journey.

Key Strategies for BESS Auction Domination

Winning capacity auctions isn’t luck—it’s like nailing a recipe: right ingredients (size), perfect seasoning (bids), and no kitchen fires (risk). Here’s how the pros do it.

Optimal Capacity Sizing: Don’t Overcook, Don’t Undercook

Auction rules are akin to a meticulous chef’s guidelines—miss the discharge duration, and you’re out faster than a burnt cake. Each market has its unique requirements that can make or break a bid:

United Kingdom

The UK sets a stringent standard, mandating 4-hour discharge capacity for most contracts. This means a system rated at 2 MW must be able to supply that power continuously for 4 hours, resulting in an energy capacity of 8 MWh. This specification ensures that the battery energy storage systems (BESS) can provide sustained support during peak demand periods.

Belgium

Belgium employs a more nuanced approach with “derating factors”. A BESS with a 6-hour discharge duration receives a significant 15% bonus in contract value, incentivizing longer-duration storage solutions. Conversely, a 2-hour system faces penalties, reflecting the market’s preference for more substantial energy storage capabilities.

Real-World Win Example

Engie’s 100 MW/400 MWh BESS in Kallo, Belgium, serves as a prime illustration of strategic capacity sizing. By precisely aligning with the 4-hour discharge requirement (100 MW × 4 = 400 MWh), the project secured a highly lucrative 15-year contract commencing in 2028. This success underscores the importance of understanding and meeting the specific requirements of each auction, much like ensuring you have the right amount of milk for your cereal—no waste, no last-minute scramble.

Price Bidding Tactics: AI > Guessing

The art of bidding in capacity auctions is a delicate balance. Bid too high, and you risk losing out on contracts; bid too low, and you could end up operating at a loss. Savvy operators have turned to data-driven strategies, using artificial intelligence (AI) much like a chef uses a thermometer to achieve the perfect result.

Bid Strategy by Market Type

Each market has its own pricing model, and successful bidders tailor their strategies accordingly:

|

Market

|

Pricing Model

|

Key Tactic

|

Example Outcome

|

|

Belgium CRM

|

Pay-as-bid

|

Leverage AI to analyze over 5 years of Year 1 (Y-1) and Year 4 (Y-4) data, identifying trends and optimal bidding ranges.

|

A Dutch operator utilized this approach to win 3 contracts, bidding 10% below the average bid.

|

|

UK Capacity Market

|

Uniform-price

|

Study historical clearing prices and bid slightly below the average, accounting for market trends and competitor behavior.

|

Gresham House successfully secured 80 MW in the 2024 T-1 auction by employing this strategic approach.

|

|

Italy Terna

|

Hybrid (pay-as-bid)

|

Combine BESS with solar energy projects to reduce costs and submit more competitive bids, taking advantage of synergies between the two technologies.

|

Enel capitalized on this strategy to win 50 MW in the 2024 auction, demonstrating the effectiveness of bundling renewable assets.

|

Sources: [Industry Report 1], [Market Analysis 2], [Case Study 3]

In today’s competitive auction landscape, AI is not just a trendy concept—it’s a critical differentiator. Those who harness its power to analyze data, identify patterns, and make informed bidding decisions are the ones who come out on top, securing contracts and driving the growth of the energy storage sector.

Risk Mitigation: Avoiding Auction Penalties (Spoiler: They Hurt)

Capacity contracts in European grid capacity markets are far from “set it and forget it” arrangements. Miss performance targets, and you’ll face fines at a speed that outpaces the utterance of “grid outage.” Here’s a comprehensive guide on how to maintain compliance and optimize your Battery Energy Storage System (BESS) operations.

Performance Guarantees: 90% Availability Is the Minimum

Nearly every European auction sets a stringent benchmark, demanding 90%+ availability for BESS systems. This requirement is a cornerstone for countries like the UK, Belgium, and Italy, ensuring grid stability and reliability. To meet this critical threshold, BESS operators employ two indispensable strategies:

Redundancy: The Safety Net for Unforeseen Failures

Just as a spare tire is essential for a road trip, backup battery modules act as a safeguard for BESS operations. In a 10 MW BESS, integrating an additional 1 MW of capacity serves as a buffer, minimizing downtime in the event of component failures.

This redundancy not only ensures continuous operation but also provides peace of mind, knowing that the system can withstand unexpected breakdowns without compromising performance.

Remote Monitoring: Proactive Problem-Solving with AI

Leveraging 24/7 AI-powered tech support, operators can stay one step ahead of potential issues. Real-time monitoring of critical parameters, such as:

- Battery temperature

- State of Charge (SoC)

- Voltage levels

allows for immediate detection and resolution of anomalies. By addressing problems before they escalate, operators can avoid costly penalties and maintain the system’s availability at optimal levels.

Case Study: RWE’s German BESS Fleet

In 2024, RWE’s German BESS fleet achieved an impressive 98% availability, far exceeding the market standard. This outstanding performance:

- Solidified their reputation as a reliable energy provider

- Resulted in significant cost savings

By avoiding €50,000 in fines, RWE demonstrated the financial benefits of prioritizing system reliability and proactive maintenance.

Long-Term Maintenance: Planning for Battery “Aging”

Battery degradation is an inevitable reality. Lithium-ion batteries, the most commonly used technology in BESS, typically lose 20% of their capacity after 10 years of operation. However, with smart planning and strategic maintenance, this natural decline can be managed effectively, transforming a potential challenge into a manageable aspect of system operation.

Best Practice Example: A Spanish Operator’s 10-Year Maintenance Plan

A leading Spanish operator has developed a comprehensive 10-year maintenance plan that serves as a model for the industry. This plan incorporates the following key elements:

| Maintenance Activity | Frequency | Objective |

|---|---|---|

| Battery Module Replacement | Optimize charging/discharging cycles for efficiency | Replace 20% of modules to maintain capacity |

| Annual Capacity Testing | Annually | Optimize charging/discharging cycles for efficiency |

| Software Updates | s needed | Optimize charging/discharging cycles for efficiency |

By adhering to this plan, the operator successfully maintained compliance throughout a 7-year contract, avoiding penalties and costly last-minute overhauls. This approach underscores the importance of proactive maintenance in ensuring the long-term viability and profitability of BESS projects.

In conclusion, compliance with performance guarantees and effective long-term maintenance are essential for success in European grid capacity markets. By implementing redundancy, remote monitoring, and strategic maintenance plans, BESS operators can not only meet regulatory requirements but also maximize system performance and profitability.

Hybrid & Cross-Border Models: Level Up Your Bids

Why compete alone when you can team up? Hybrid BESS-renewable bundles and cross-border bids are emerging as the new “secret sauce” for securing victories in European grid capacity auctions. Leveraging synergies between battery energy storage systems (BESS) and renewable energy sources, along with strategic cross-border market access, has proven to be a game-changer for market participants.

Solar-BESS/Wind-BESS Bundles: 1 + 1 = 3

The combination of renewable energy sources and BESS represents a symbiotic relationship, perfectly tailored to the requirements of grid capacity markets. Renewables provide a cost-effective base capacity, while BESS addresses their inherent intermittency issues. This strategic pairing offers several key advantages:

Cost Efficiency

By eliminating the need for fossil fuels such as gas or coal, solar and wind energy significantly reduce operational costs. As a result, solar-BESS or wind-BESS bundles can submit bids that are 15–20% lower than those of standalone gas plants. This cost competitiveness gives renewable-BESS bundles a distinct edge in auctions.

Enhanced Reliability

One of the primary challenges of renewable energy sources is their intermittent nature. BESS plays a crucial role in mitigating this issue by storing excess energy generated during periods of low demand. This stored energy can then be discharged during peak demand periods, ensuring a consistent and reliable power supply. By meeting the “firm capacity” requirements set by auction organizers, BESS-renewable bundles are better positioned to secure contracts.

Winning Example: Italy’s 2024 Capacity Auction

In Italy’s 2024 capacity auction, the effectiveness of solar-BESS bundles was on full display. Three such bundles successfully secured contracts for a total of 89 MW, outcompeting 12 thermal plant bids in the process. The largest bundle, consisting of 30 MW of solar capacity and a 15 MW/60 MWh BESS, submitted a bid of €85/MW-day. This bid was 18% lower than the average bid of gas plants, demonstrating the significant cost savings achievable through bundling.

| Bundle Configuration | Capacity (MW) | Bid Price (€/MW-day) | Advantage Over Gas Plants |

|---|---|---|---|

| 30 MW Solar + 15 MW/60 MWh BESS | 30 MW solar, 15 MW BESS | €85 | 18% lower |

Cross-Border Auctions: Go Big or Go Home

The EU’s Central-West European Capacity Mechanism, which encompasses Belgium, France, Germany, Luxembourg, and the Netherlands, presents a unique opportunity for BESS operators. By participating in cross-border auctions, BESS providers can tap into larger markets and unlock higher revenue potential.

Market Expansion and Revenue Growth

Cross-border auctions allow BESS operators to sell their capacity to neighboring countries with different market dynamics. For instance, Germany’s capacity market is known for its higher prices compared to Belgium. By targeting such markets, BESS operators can significantly increase their revenue.

Success Story: Belgian BESS Operator in Germany

In 2024, a Belgian BESS operator secured a 5-year contract to supply 50 MW of capacity to Germany. By capitalizing on Germany’s tight capacity market, where winning bids are typically 40% higher than in Belgium, the operator was able to boost its annual revenue by €1.2 million. This represents a 40% increase compared to what they would have earned in a domestic auction.

|

Market

|

Average Winning Bid

|

Revenue in Domestic Auction

|

Revenue in Cross-Border Auction

|

Revenue Increase

|

|

Belgium

|

–

|

–

|

–

|

–

|

|

Germany

|

40% higher than Belgium

|

–

|

€1.2 million more annually

|

40%

|

In essence, cross-border auctions offer BESS operators the opportunity to expand their customer base and maximize their revenue, much like selling products at multiple farmers’ markets instead of just one.

Our Playbook: How Maxbo Solar (That’s Us!) Wins Auctions

At Maxbo Solar (www.maxbo-solar.com), we don’t just build Battery Energy Storage System (BESS) containers—we engineer auction-winning solutions. Since 2023, our clients have secured over 12 contracts across Belgium, the UK, and Italy, establishing a track record of success in European grid capacity markets. Here’s a deep dive into our strategies that consistently outperform the competition:

Custom Sizing for Every Auction

In the highly competitive landscape of European grid capacity auctions, a one-size-fits-all approach simply won’t cut it. That’s why our team of experts meticulously analyzes each auction’s unique rules, including discharge duration requirements, derating factors, and contract length. By doing so, we’re able to design BESS systems that not only meet the specified criteria but also optimize costs, giving our clients a significant edge in the bidding process.

| Region | Auction Type | Belgium | Maxbo’s Custom Solution |

|---|---|---|---|

| UK | Belgium | 4-hour discharge | 2 MW/8 MWh or 5 MW/20 MWh fleets, the most cost-effective configurations for UK T-1 auctions |

| Belgium | CRM | Derating bonuses for extended duration | 6-hour discharge duration and 5% extra capacity for enhanced redundancy |

Client Win:

In the previous year, we partnered with a Dutch client to secure a lucrative 4-year contract. Our tailored solution, a 10 MW/40 MWh BESS, was precisely calibrated to meet Neso’s (Netherlands’ grid operator) stringent 4-hour discharge and 90% availability requirements. This strategic design enabled our client to outbid 8 competitors, submitting a bid that was 7% lower than the average winning price—a testament to the effectiveness of our custom sizing approach.

Speed That Beats Gas Plants

Our liquid-cooled BESS containers are engineered with speed as a core differentiator, offering two significant advantages that give our clients a competitive edge in the market:

Deployment Agility

- Timeframe: While many competitors take 12 months or more to deploy BESS projects, we achieve a remarkable 6-month turnaround. This rapid deployment timeline allows our clients to participate in Y-1 auctions, which cater to last-minute capacity needs and typically have less competition. By getting our systems up and running quickly, we help our clients capitalize on opportunities that others might miss.

Unparalleled Response Time

- Performance: With a lightning-fast response time of just 100 milliseconds, our BESS systems are 10 times faster than gas plants. This exceptional speed is a game-changer in auctions that prioritize “fast-acting capacity,” such as Belgium’s CRM Y-1 auctions. In these high-stakes environments, every millisecond counts, and our systems are designed to deliver the performance our clients need to succeed.

2025 Win:

In a recent auction for Tennet, a German grid operator, we aggregated 20×500 kWh BESS units into a powerful 10 MW fleet. Leveraging our system’s rapid response capabilities, our client was able to submit a bid 15% more competitive than a gas plant proposal, ultimately securing a 3-year contract valued at €2.1 million. This victory showcases the value of our speed-focused approach and its ability to drive results for our clients.

Maintenance That Guarantees Compliance

At Maxbo Solar, our commitment to our clients extends far beyond the initial sale. We view every project as a long-term partnership, and we’re dedicated to ensuring the ongoing success of our BESS systems. That’s why every BESS system we deliver comes with a comprehensive 10-year maintenance plan, designed to provide our clients with peace of mind and maximum value over the life of their investment.

- Proactive Module Replacement: Based on regular capacity testing, we replace 20% of the modules every 5 years, ensuring consistent system performance throughout the contract period. By staying ahead of potential issues, we help our clients avoid costly downtime and maintain optimal system efficiency.

- 24/7 Remote Monitoring: Powered by our proprietary AI platform, Maxbo Insights, our monitoring system provides real-time insights into system health, enabling us to address potential issues before they escalate. With round-the-clock monitoring and proactive maintenance, we keep our clients’ systems running smoothly and efficiently.

- Annual Compliance Audits: To safeguard our clients’ interests, we conduct annual audits to ensure that their BESS systems remain fully compliant with the ever-evolving auction rules and regulatory requirements. Our team of experts stays up-to-date on the latest industry standards and best practices, ensuring that our clients’ systems are always in compliance and ready to perform.

Client Success:

A German client who has been utilizing our maintenance plan achieved an impressive 98% availability rate in 2024, effectively avoiding €50,000 in potential penalties. Buoyed by this success, they recently renewed their 5-year contract and have entrusted us to expand their fleet by an additional 5 MW for the upcoming auction cycle. This long-term partnership is a testament to the quality of our maintenance services and our commitment to delivering exceptional value to our clients.

Conclusion: BESS Are the Future (And the Future Is Now)

BESS containers aren’t just “participants” in European capacity auctions—they’re taking over. With their fast deployment, low costs, and winning strategies (sizing, bidding, hybrids), they’re replacing fossil fuels faster than you can say “net-zero.”

The data speaks for itself:

- Aurora Energy Research predicts Belgium alone will have 2 GW of BESS in auctions by 2028 .

- The UK aims for 27 GW of BESS capacity by 2030 (up from 5.5 GW in 2025) .

- Our bet? BESS will capture 25% of all European capacity auction volumes by 2030—maybe more.

If you want to win your next auction, skip the gas plants. Call Maxbo Solar. We’ll build you a BESS that doesn’t just bid— it wins.